Business, 15.02.2020 01:49 emilysmith20044

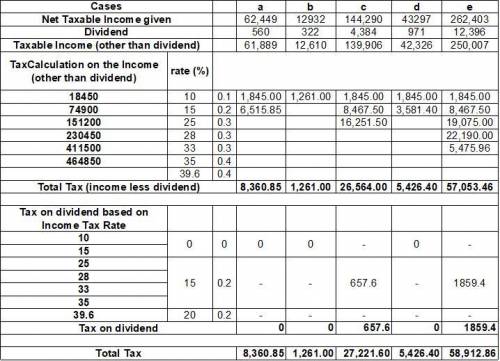

Problem 3-38 (LO 3-3) Determine the amount of tax liability in the following situations. In all cases, the taxpayer is using the filing status of married filing jointly. Use the appropriate Tax Tables or Tax Rate Schedules. Taxable income of $62,449 that includes a qualified dividend of $560. Taxable income of $12,932 that includes a qualified dividend of $322. Taxable income of $144,290 that includes a qualified dividend of $4,384. (Round your intermediate computations to 2 decimal places and final answer to the nearest whole dollar amount.) Taxable income of $43,297 that includes a qualified dividend of $971. Taxable income of $262,403 that includes a qualified dividend of $12,396. (Round your intermediate computations to 2 decimal places and final answer to the nearest whole dollar amount.) (For all requirements, use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000.)

Answers: 2

Another question on Business

Business, 21.06.2019 17:30

If you want to compare two different investments, what should you calculate

Answers: 2

Business, 21.06.2019 20:30

Licensing is perhaps the easiest method of entering into international trade. another method of entering international trade, which can be relatively low risk, is which opens several levels of involvement to company

Answers: 2

Business, 21.06.2019 21:00

The plastic flowerpots company has two manufacturing departments, molding and packaging. at the beginning of the month, the molding department has 2,100 units in inventory, 70% complete as to materials. during the month, the molding department started 18,500 units. at the end of the month, the molding department had 3,150 units in ending inventory, 80% complete as to materials. units completed in the molding department are transferred into the packaging department. cost information for the molding department for the month follows: beginning work in process inventory (direct materials) $ 1,300 direct materials added during the month 28,900 using the weighted-average method, compute the molding department's (a) equivalent units of production for materials and (b) cost per equivalent unit of production for materials for the month. (round "cost per equivalent unit of production" to 2 decimal places.)

Answers: 1

Business, 22.06.2019 14:10

When a shortage or a surplus arises in the loanable funds market a. the supply of loanable funds changes to return the economy to its original real interest rate b. the nominal interest rate is pulled to the new equilibrium level c. the demand for loanable funds changes to return the economy to its original real interest rate d. the real interest rate is pulled to the new equilibrium level

Answers: 3

You know the right answer?

Problem 3-38 (LO 3-3) Determine the amount of tax liability in the following situations. In all case...

Questions

Computers and Technology, 19.12.2020 06:30

English, 19.12.2020 06:30

Mathematics, 19.12.2020 06:30

Spanish, 19.12.2020 06:30

History, 19.12.2020 06:30

Spanish, 19.12.2020 06:40

Mathematics, 19.12.2020 06:40

Spanish, 19.12.2020 06:40

Biology, 19.12.2020 06:40

Mathematics, 19.12.2020 06:40

History, 19.12.2020 06:40

Mathematics, 19.12.2020 06:40