A substance used in biological and medical research is shipped by air-freight to users in cartons of 1,000 ampules. The data below, involving 10 shipments, were collected on the number of times the carton was transferred from one aircraft to another over the shipment route (X) and the number of ampules found to be broken upon arrival (Y). Assume that first-order regression model is appropriate.

i. 1 2 3 4 5 6 7 8 9 10

Xi. 1 0 2 0 3 1 0 1 2 0

Yi. 16 9 17 12 22 13 8 15 19 11

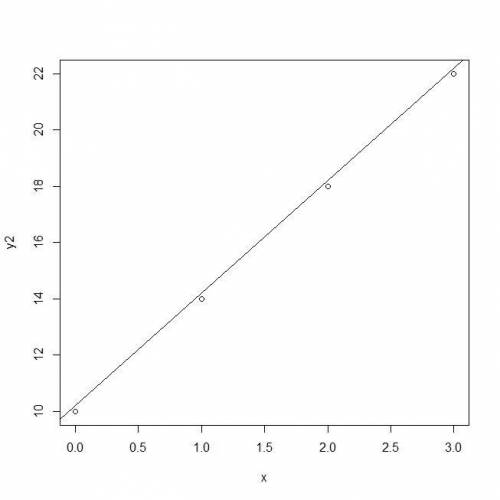

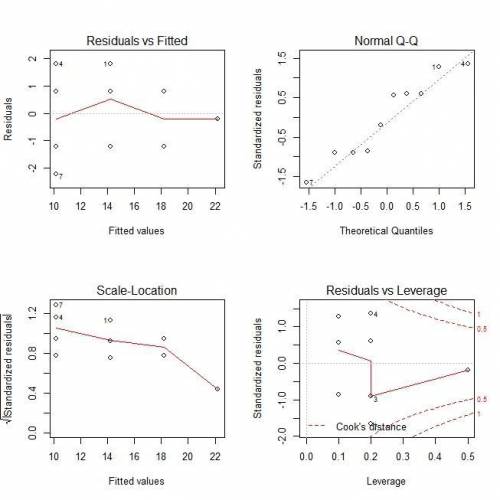

a. Obtain the estimated regression function. Plot the estimated regression function and the data. Does a linear regression function appear to give a good fit here?

b. Obtain a point estimate of the expected number of broken ampules when X = 1 transfer is made.

c. Estimate the increase in the expected number of ampules broken when there are 2 transfers as compared to 1 transfer.

d. Verify that your fitted regression line goes through the point (X bar, Y bar)

e. Calcuate s.

f. Test the hypothesis that beta1=0, using alpha=0.05.

Answers: 1

Another question on Business

Business, 22.06.2019 08:00

Shrieves casting company is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by sidney johnson, a recently graduated mba. the production line would be set up in unused space in the main plant. the machinery’s invoice price would be approximately $200,000, another $10,000 in shipping charges would be required, and it would cost an additional $30,000 to install the equipment. the machinery has an economic life of 4 years, and shrieves has obtained a special tax ruling that places the equipment in the macrs 3-year class. the machinery is expected to have a salvage value of $25,000 after 4 years of use. the new line would generate incremental sales of 1,250 units per year for 4 years at an incremental cost of $100 per unit in the first year, excluding depreciation. each unit can be sold for $200 in the first year. the sales price and cost are both expected to increase by 3% per year due to inflation. further, to handle the new line, the firm’s net working capital would have to increase by an amount equal to 12% of sales revenues. the firm’s tax rate is 40%, and its overall weighted average cost of capital, which is the risk-adjusted cost of capital for an average project (r), is 10%. define “incremental cash flow.” (1) should you subtract interest expense or dividends when calculating project cash flow?

Answers: 1

Business, 22.06.2019 16:40

Based on what you learned about time management which of these statements are true

Answers: 1

Business, 22.06.2019 20:00

Suppose a country's productivity last year was 84. if this country's productivity growth rate of 5 percent is to be maintained, this means that this year's productivity will have to be:

Answers: 2

Business, 22.06.2019 20:50

Happy foods and general grains both produce similar puffed rice breakfast cereals. for both companies, thecost of producing a box of cereal is 45 cents, and it is not possible for either company to lower their productioncosts any further. how can one company achieve a competitive advantage over the other?

Answers: 1

You know the right answer?

A substance used in biological and medical research is shipped by air-freight to users in cartons of...

Questions

Mathematics, 05.06.2020 17:59

Mathematics, 05.06.2020 17:59

History, 05.06.2020 17:59

History, 05.06.2020 17:59

Mathematics, 05.06.2020 17:59

Mathematics, 05.06.2020 17:59

History, 05.06.2020 17:59

Mathematics, 05.06.2020 17:59

History, 05.06.2020 17:59

Mathematics, 05.06.2020 17:59