Business, 15.02.2020 06:10 kargarzadehsm

Vulcan Service Co. experienced the following transactions for Year 1, its first year of operations: Provided $91,000 of services on account. Collected $72,000 cash from accounts receivable. Paid $36,000 of salary expense for the year. Adjusted the accounts using the following information from accounts receivable aging schedule:

Number of Days Past Due Amount Percent Likely to Be Uncollectible Allowance Balance

Current $24,864 0.01

0-30 1,680 0.05

31-60 2,352 0.10

61-90 2,016 0.30

Over 90 days 2,688 0.50

Required:

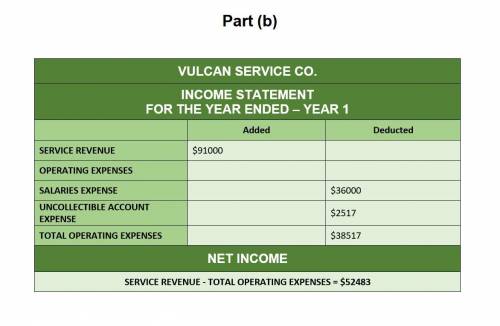

a. Record the above transactions in general journal form and post to T-accounts.

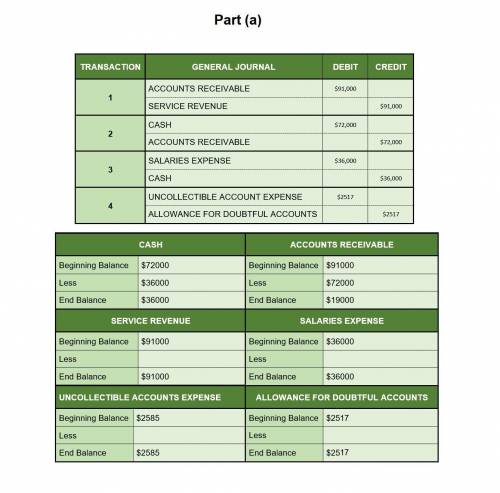

b. Prepare the income statement for Vulcan Service Co. for Year 1.

c. What is the net realizable value of the accounts receivable at December 31, Year 1?

Answers: 3

Another question on Business

Business, 22.06.2019 04:40

Select the correct text in the passage.which sentences in the given passage explains the limitations of monetary policies? monetary policies - limitationsmonetary policies are set by the central bank to bring about growth in the economy.de can be achieved these policiesw at anden i sca poit would be fair to say that changes in the economy cannot be brought about instantly by monetary po des.monetary policy can only influence not control, economic growththe monetary policy makers do work on sining the perfect balance between demand and supply of money in the economy

Answers: 3

Business, 22.06.2019 07:30

Which of the following is an example of an unsought good? a. cameron purchases a new bike. b. jordan buys paper towels. c. taylor buys cupcakes from her favorite bakery. d. riley buys new windshield wipers for her car.

Answers: 3

Business, 22.06.2019 11:00

In each of the following cases, find the unknown variable. ignore taxes. (do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) accounting unit price unit variable cost fixed costs depreciation break-even 20,500 $ 44 $ 24 $ 275,000 $ 133,500 44 4,400,000 940,000 8,000 75 320,000 80,000

Answers: 3

Business, 22.06.2019 15:20

Martinez company has the following two temporary differences between its income tax expense and income taxes payable. 2017 2018 2019 pretax financial income $873,000 $866,000 $947,000 (2017' 2018, 2019) excess depreciation expense on tax return (29,400 ) (39,000 ) (9,600 ) (2017' 2018, 2019) excess warranty expense in financial income 20,000 9,900 8,300 (2017' 2018, 2019) taxable income $863,600 $836,900 $945,700(2017' 2018, 2019) the income tax rate for all years is 40%. instructions: a. prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. b. assuming there were no temporary differences prior to 2016, indicate how deferred taxes will be reported on the 2016 balance sheet. button's warranty is for 12 months. c. prepare the income tax expense section of the income statement for 2017, beginning with the line, "pretax financial income."

Answers: 3

You know the right answer?

Vulcan Service Co. experienced the following transactions for Year 1, its first year of operations:...

Questions

History, 10.01.2020 09:31

Mathematics, 10.01.2020 09:31

Mathematics, 10.01.2020 09:31

History, 10.01.2020 09:31

Mathematics, 10.01.2020 09:31

Mathematics, 10.01.2020 09:31

Mathematics, 10.01.2020 09:31

Mathematics, 10.01.2020 09:31

$2517

$2517