Business, 17.02.2020 19:05 nickolasbradyp0hvwl

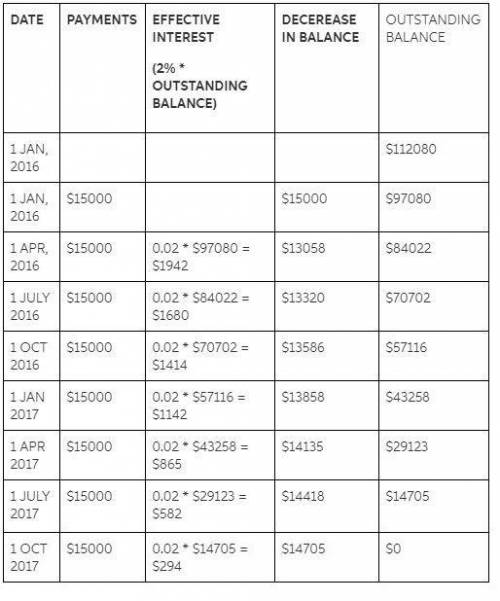

Manufacturers Southern leased high-tech electronic equipment from Edison Leasing on January 1, 2013. Edison purchased the equipment from International Machines at a cost of $112,080.

Related Information:

Lease term 2 years (8 quarterly periods)

Quarterly rental payments $15,000 at the beginning of each period

Economic life of asset 2 years

Fair value of asset $112,080

Implicit interest rate 8%

(Also lessee's incremental borrowing rate)

Required:

Prepare a lease amortization schedule and appropriate entries for Manufacturers Southern from the inception of the lease through January 1, 2014. Depreciation is recorded at the end of each fiscal year (December 31) on a straight-line basis.

Answers: 1

Another question on Business

Business, 21.06.2019 14:00

In the context of your career choice, your own business skills cannot influence the level of your personal financial success. a. true b. false

Answers: 2

Business, 21.06.2019 20:30

What does the phrase limited liability mean in a corporate context?

Answers: 2

Business, 22.06.2019 01:30

Side bar toggle icon performance in last 10 qs hard easy performance in last 10 questions - there are '3' correct answers, '3' wrong answers, '0' skipped answers, '1' partially correct answers about this question question difficulty difficulty 60% 42.2% students got it correct study this topic • demonstrate an understanding of sampling distributions question number q 3.8: choose the correct estimate for the standard error using the 95% rule.

Answers: 2

Business, 23.06.2019 01:30

What happens when the government finances a job creation project through taxes and borrowing?

Answers: 3

You know the right answer?

Manufacturers Southern leased high-tech electronic equipment from Edison Leasing on January 1, 2013....

Questions

Social Studies, 28.08.2019 08:30

History, 28.08.2019 08:30

Social Studies, 28.08.2019 08:30

Computers and Technology, 28.08.2019 08:30

Chemistry, 28.08.2019 08:30

History, 28.08.2019 08:30

Mathematics, 28.08.2019 08:30

Social Studies, 28.08.2019 08:30

Mathematics, 28.08.2019 08:30

History, 28.08.2019 08:30

Mathematics, 28.08.2019 08:30

Mathematics, 28.08.2019 08:30