Costanza Company experienced the following events and transactions during July.

July 1 Receive...

Business, 18.02.2020 01:05 victoria8281

Costanza Company experienced the following events and transactions during July.

July 1 Received $3,000 cash in advance of performing work for Vivian Solana.

6 Received $7,500 cash in advance of performing work for Iris Haru.

12 Completed the job for Solana.

18 Received $8,500 cash in advance of performing work for Amina Jordan.

27 Completed the job for Haru.

31 None of the work for Jordan has been performed.

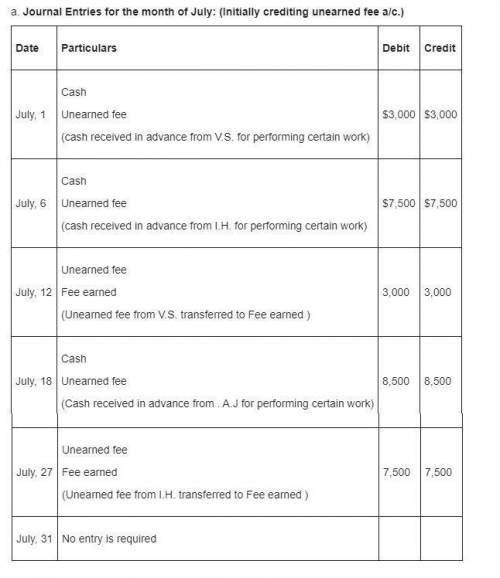

a.

Prepare journal entries (including any adjusting entries as of the end of the month) to record these events using the procedure of initially crediting the Unearned Fees account when payment is received from a customer in advance of performing services.(If no journal entry is required for a particular transaction, select "No journal entry required" in the first account field.)

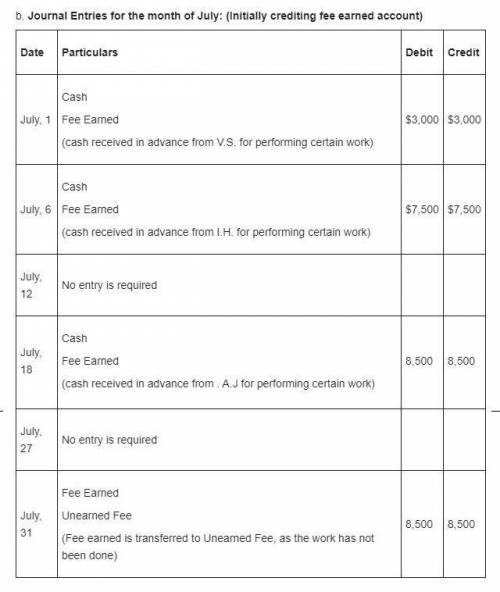

b.

Prepare journal entries (including any adjusting entries as of the end of the month) to record these events using the procedure of initially crediting the Fees Earned account when payment is received from a customer in advance of performing services.(If no journal entry is required for a particular transaction, select "No journal entry required" in the first account field.)

c.

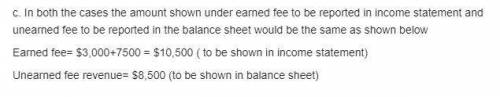

Under each method, determine the amount of earned fees reported on the income statement for July and the amount of unearned fees reported on the balance sheet as of July 31.

Under the first method (and using entries from a)

Answers: 2

Another question on Business

Business, 22.06.2019 02:00

Greater concern for innovation and quality has shifted the job trend to using more broadly defined jobs. t/f

Answers: 1

Business, 22.06.2019 06:00

List three careers that require knowledge of science. list three careers that require the use of of math. list three careers that require the use of foreign language. list three careers that require the use of good writing skills. list three careers that require the use of good computer skills.

Answers: 3

Business, 22.06.2019 08:00

Lavage rapide is a canadian company that owns and operates a large automatic car wash facility near montreal. the following table provides data concerning the company’s costs: fixed cost per month cost per car washed cleaning supplies $ 0.70 electricity $ 1,400 $ 0.07 maintenance $ 0.15 wages and salaries $ 4,900 $ 0.30 depreciation $ 8,300 rent $ 1,900 administrative expenses $ 1,400 $ 0.03 for example, electricity costs are $1,400 per month plus $0.07 per car washed. the company expects to wash 8,000 cars in august and to collect an average of $6.50 per car washed. the actual operating results for august appear below. lavage rapide income statement for the month ended august 31 actual cars washed 8,100 revenue $ 54,100 expenses: cleaning supplies 6,100 electricity 1,930 maintenance 1,440 wages and salaries 7,660 depreciation 8,300 rent 2,100 administrative expenses 1,540 total expense 29,070 net operating income $ 25,030 required: calculate the company's revenue and spending variances for august.

Answers: 3

Business, 22.06.2019 10:00

Scenario: you have advised the owner of bond's gym that the best thing to do would be to raise the price of a monthly membership. the owner wants to know what may happen once this price increase goes into effect. what will most likely occur after the price of a monthly membership increases? check all that apply. current members will pay more per month. the quantity demanded for memberships will decrease. the number of available memberships will increase. the owner will make more money. bond's gym will receive more membership applications.

Answers: 1

You know the right answer?

Questions

Mathematics, 22.02.2021 21:00

Mathematics, 22.02.2021 21:00

Mathematics, 22.02.2021 21:00

Mathematics, 22.02.2021 21:00

Mathematics, 22.02.2021 21:00

Mathematics, 22.02.2021 21:00

Chemistry, 22.02.2021 21:00