Business, 19.02.2020 03:27 angelteddy033

Consider three bonds with 8% coupon rates, all making annual coupon payments and all selling at a face value of $1,000. The short-term bond has a maturity of 4 years, the intermediate-term bond has maturity 8 years, and the long-term bond has maturity 30 years.

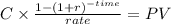

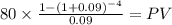

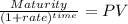

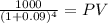

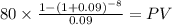

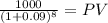

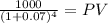

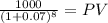

a. What will be the price of the 4-year bond if its yield increases to 9%?

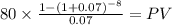

b. What will be the price of the 8-year bond if its yield increases to 9%?

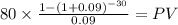

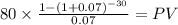

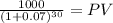

c. What will be the price of the 30-year bond if its yield increases to 9%?

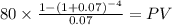

d. What will be the price of the 4-year bond if its yield decreases to 7%?

e. What will be the price of the 8-year bond if its yield decreases to 7%?

f. What will be the price of the 30-year bond if its yield decreases to 7%?

Answers: 1

Another question on Business

Business, 22.06.2019 09:40

The relationship requirement for qualifying relative requires the potential qualifying relative to have a family relationship with the taxpayer. t or fwhich of the following is not a from agi deduction? a.standard deductionb.itemized deductionc.personal exemptiond.none of these. all of these are from agi deductions

Answers: 3

Business, 22.06.2019 19:00

The demand curve determines equilibrium price in a market. is a graphical representation of the relationship between price and quantity demanded. depicts the relationship between production costs and output. is a graphical representation of the relationship between price and quantity supplied.

Answers: 1

Business, 23.06.2019 10:50

In the context in which your reading material uses the term traffic patterns are

Answers: 1

Business, 23.06.2019 12:30

Mason farms purchased a building for $689,000 eight years ago. six years ago, repairs costing $136,000 were made to the building. the annual taxes on the property are $11,000. the building has a current market value of $840,000 and a current book value of $494,000. the building is totally paid for and solely owned by the firm. if the company decides to use this building for a new project, what value, if any, should be included in the initial cash flow of the project for this building? $0$582,000$840,000$865,000$953,000

Answers: 3

You know the right answer?

Consider three bonds with 8% coupon rates, all making annual coupon payments and all selling at a fa...

Questions

Physics, 05.10.2019 05:30

Social Studies, 05.10.2019 05:30

Social Studies, 05.10.2019 05:30

History, 05.10.2019 05:30

Social Studies, 05.10.2019 05:30

Mathematics, 05.10.2019 05:30

Computers and Technology, 05.10.2019 05:30

Physics, 05.10.2019 05:30