Answers: 3

Another question on Business

Business, 21.06.2019 20:00

Which of the following statements is true about financial planning

Answers: 2

Business, 21.06.2019 22:40

Job a3b was ordered by a customer on september 25. during the month of september, jaycee corporation requisitioned $2,400 of direct materials and used $3,900 of direct labor. the job was not finished by the end of the month, but needed an additional $2,900 of direct materials in october and additional direct labor of $6,400 to finish the job. the company applies overhead at the end of each month at a rate of 100% of the direct labor cost. what is the amount of job costs added to work in process inventory during october?

Answers: 3

Business, 22.06.2019 10:30

You meet that special person and get married. amazingly your spouse has exactly the same income you do 47,810. if your tax status is now married filing jointly what is your tax liability

Answers: 2

Business, 22.06.2019 14:10

Carey company is borrowing $225,000 for one year at 9.5 percent from second intrastate bank. the bank requires a 15 percent compensating balance. the principal refers to funds the firm can effectively utilize (amount borrowed − compensating balance). a. what is the effective rate of interest? (use a 360-day year. input your answer as a percent rounded to 2 decimal places.) b. what would the effective rate be if carey were required to make 12 equal monthly payments to retire the loan?

Answers: 1

You know the right answer?

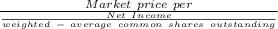

A company has net income of $90,000; its weighted-average common shares outstanding are 18,000. Its...

Questions

Mathematics, 06.11.2021 06:30

French, 06.11.2021 06:30

Mathematics, 06.11.2021 06:30

Mathematics, 06.11.2021 06:30

Mathematics, 06.11.2021 06:30

Computers and Technology, 06.11.2021 06:30

Computers and Technology, 06.11.2021 06:30

Business, 06.11.2021 06:30

Mathematics, 06.11.2021 06:30