Business, 20.02.2020 20:02 joooselinn9688

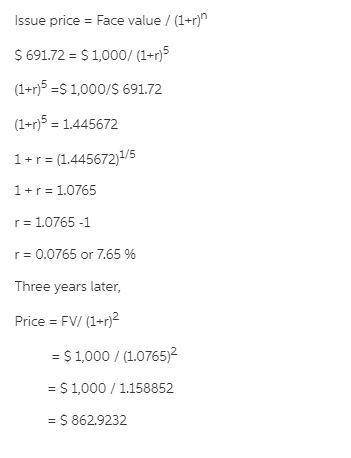

If you purchase a 5-year, zero-coupon bond for $691.72, how much could it be sold for 3 years later if interest rates have remained stable?

Answers: 3

Another question on Business

Business, 21.06.2019 20:50

Which of the following statements is not correct? 1) trade allows for specialization. 2) trade has the potential to benefit all nations. 3) trade allows nations to consume outside of their production possibilities curves. 4) absolute advantage is the driving force of specialization.

Answers: 3

Business, 22.06.2019 10:20

Asmartphone manufacturing company uses social media to achieve different business objectives. match each social media activity of the company to the objective it the company achieve.

Answers: 1

Business, 22.06.2019 10:50

Explain whether each of the following events increases, decreases, or has no effect on the unemployment rate and the labor-force participation rate.a. after a long search, jon finds a job.b. tyrion, a full-time college student, graduates and is immediately employed.c. after an unsuccessful job search, arya gives up looking and retires.d. daenerys quits her job to become a stay-at-home mom.e. sansa has a birthday, becomes an adult, but has no interest in working.f. jaime has a birthday, becomes an adult, and starts looking for a job.g. cersei dies while enjoying retirement.h. jorah dies working long hours at the office.

Answers: 2

Business, 22.06.2019 11:10

An insurance company estimates the probability of an earthquake in the next year to be 0.0015. the average damage done to a house by an earthquake it estimates to be $90,000. if the company offers earthquake insurance for $150, what is company`s expected value of the policy? hint: think, is it profitable for the insurance company or not? will they gain (positive expected value) or lose (negative expected value)? if the expected value is negative, remember to show "-" sign. no "+" sign needed for the positive expected value

Answers: 2

You know the right answer?

If you purchase a 5-year, zero-coupon bond for $691.72, how much could it be sold for 3 years later...

Questions

Biology, 25.05.2020 23:58

History, 25.05.2020 23:58

Mathematics, 25.05.2020 23:58

Mathematics, 25.05.2020 23:58

Mathematics, 25.05.2020 23:58

Mathematics, 25.05.2020 23:58

Mathematics, 25.05.2020 23:58

Social Studies, 25.05.2020 23:58

History, 25.05.2020 23:58

Chemistry, 25.05.2020 23:58

Mathematics, 25.05.2020 23:58

Physics, 25.05.2020 23:58

Mathematics, 25.05.2020 23:58

Mathematics, 25.05.2020 23:58

Mathematics, 25.05.2020 23:58