Business, 21.02.2020 02:58 beevus2666

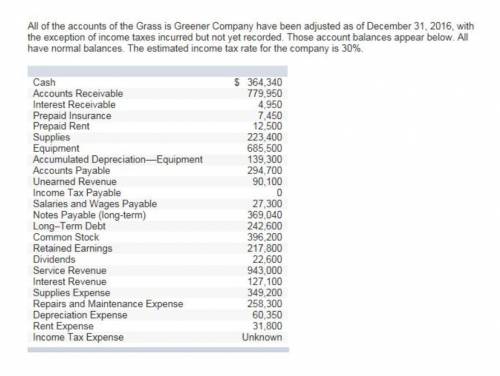

All of the accounts of the Grass is Greener Company have been adjusted as of December 31, 2016, with the exception of income taxes incurred but not yet recorded. Those account balances appear below. All have normal balances. The estimated income tax rate for the company is 30%. 364,340 Cash Accounts Receivable 779,950 Interest Receivable 4.950 Prepaid Insurance 7,450 Prepaid Rent 12,500 223,400 Supplies Equipment 685,500 139,300 Accumulated Depreciation Equipment 294,700 Accounts Payable Unearned Revenue 90,100 Income Tax Payable 27,300 Salaries and Wages Payable 369,040 Notes Payable (long-term) 242,600 Long-Term Debt Common Stock 396,200 Retained Earnings 217,800 22,600 Dividends 943,000 Service Revenue Interest Revenue 127,100 349,200 Supplies Expense Repairs and Maintenance Expense 258,300 Depreciation Expense 60,350 31,800 Rent Exp ense Income Tax Expense Unknown

Answers: 3

Another question on Business

Business, 22.06.2019 07:10

mark, a civil engineer, entered into a contract with david. as per the contract, mark agreed to design and build a house for david for a specified fee. mark provided david with an estimation of the total cost and the contract was mutually agreed upon. however, during construction, when mark increased the price due to a miscalculation on his part, david refused to pay the amount. this scenario is an example of a mistake.

Answers: 1

Business, 22.06.2019 07:30

Miko willingly admits that she is not an accountant by training. she is concerned that her balance sheet might not be correct. she has provided you with the following additional information. 1. the boat actually belongs to miko, not to skysong, inc.. however, because she thinks she might take customers out on the boat occasionally, she decided to list it as an asset of the company. to be consistent, she also listed as a liability of the corporation her personal loan that she took out at the bank to buy the boat. 2. the inventory was originally purchased for $27,500, but due to a surge in demand miko now thinks she could sell it for $39,600. she thought it would be best to record it at $39,600. 3. included in the accounts receivable balance is $11,000 that miko loaned to her brother 5 years ago. miko included this in the receivables of skysong, inc. so she wouldn’t forget that her brother owes her money. (b) provide a corrected balance sheet for skysong, inc.. (hint: to get the balance sheet to balance, adjust stockholders’ equity.) (list assets in order of liquidity.)

Answers: 1

Business, 22.06.2019 10:30

Perez, inc., applies the equity method for its 25 percent investment in senior, inc. during 2018, perez sold goods with a 40 percent gross profit to senior, which sold all of these goods in 2018. how should perez report the effect of the intra-entity sale on its 2018 income statement?

Answers: 2

Business, 22.06.2019 17:30

Palmer frosted flakes company offers its customers a pottery cereal bowl if they send in 3 boxtops from palmer frosted flakes boxes and $1. the company estimates that 60% of the boxtops will be redeemed. in 2012, the company sold 675,000 boxes of frosted flakes and customers redeemed 330,000 boxtops receiving 110,000 bowls. if the bowls cost palmer company $3 each, how much liability for outstanding premiums should be recorded at the end of 2012?

Answers: 2

You know the right answer?

All of the accounts of the Grass is Greener Company have been adjusted as of December 31, 2016, with...

Questions

Mathematics, 06.12.2021 20:30

Physics, 06.12.2021 20:30

English, 06.12.2021 20:30

Biology, 06.12.2021 20:30

Mathematics, 06.12.2021 20:30

Mathematics, 06.12.2021 20:30

English, 06.12.2021 20:30

Biology, 06.12.2021 20:30

Mathematics, 06.12.2021 20:30

Mathematics, 06.12.2021 20:30