Business, 21.02.2020 18:38 rleiphart1

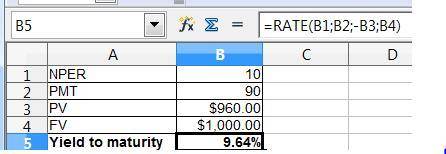

Airborne Airlines Inc. has a $1,000 par value bond outstanding with 10 years to maturity. The bond carries an annual interest payment of $90 and is currently selling for $960. Airborne is in a 20 percent tax bracket. The firm wishes to know what the aftertax cost of a new bond issue is likely to be. The yield to maturity on the new issue will be the same as the yield to maturity on the old issue because the risk and maturity date will be similar.

Required:

a. Compute the yield to maturity on the old issue and use this as the yield for the new issue. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.)

b. Make the appropriate tax adjustment to determine the aftertax cost of debt. (Do not round intermediate calculations.

Answers: 2

Another question on Business

Business, 22.06.2019 11:00

%of the world's population controls approximately % of the world's finances (the sum of gross domestic products)" quizlket

Answers: 1

Business, 22.06.2019 15:00

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 2

Business, 22.06.2019 17:40

Turrubiates corporation makes a product that uses a material with the following standards standard quantity 8.0 liters per unit standard price $2.50 per liter standard cost $20.00 per unit the company budgeted for production of 3,800 units in april, but actual production was 3,900 units. the company used 32,000 liters of direct material to produce this output. the company purchased 20,100 liters of the direct material at $2.6 per liter. the direct materials purchases variance is computed when the materials are purchased. the materials quantity variance for april is:

Answers: 1

Business, 22.06.2019 18:00

In which job role will you be creating e-papers, newsletters, and periodicals?

Answers: 1

You know the right answer?

Airborne Airlines Inc. has a $1,000 par value bond outstanding with 10 years to maturity. The bond c...

Questions

Biology, 12.02.2021 18:40

Chemistry, 12.02.2021 18:40

Mathematics, 12.02.2021 18:40

Mathematics, 12.02.2021 18:40

Mathematics, 12.02.2021 18:40

Mathematics, 12.02.2021 18:40

Mathematics, 12.02.2021 18:40

English, 12.02.2021 18:40

Mathematics, 12.02.2021 18:40

Mathematics, 12.02.2021 18:40

Social Studies, 12.02.2021 18:40

Mathematics, 12.02.2021 18:40