Business, 22.02.2020 02:07 venancialee8805

On January 1, 2014, Aumont Company sold 12% bonds having a maturity value of $500,000 for $537,907, which provides the bondholders with a 10% yield. The bonds are dated January 1, 2014, and mature January 1, 2019, with interest payable December 31 of each year. Aumont Company allocates interest and unamortized discount or premium on the effective-interest basis.

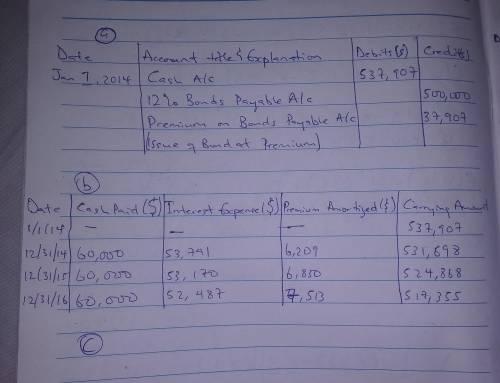

(a) Prepare the journal entry at the date of the bond issuance. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

January 1, 2014

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

(b) Prepare a schedule of interest expense and bond amortization for 2014?2016. (Round answers to 0 decimal places, e. g. 38,548.)

Schedule of Interest Expense and Bond Premium Amortization

Effective-Interest Method

Date

Cash

Paid

Interest

Expense

Premium

Amortized

Carrying

Amount of Bonds

1/1/14 $On January 1, 2014, Aumont Company sold 12% bonds $On January 1, 2014, Aumont Company sold 12% bonds $On January 1, 2014, Aumont Company sold 12% bonds $On January 1, 2014, Aumont Company sold 12% bonds

12/31/14 On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds

12/31/15 On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds

12/31/16 On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds

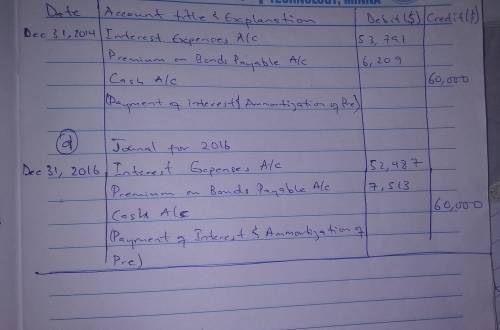

(c) Prepare the journal entry to record the interest payment and the amortization for 2014. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

December 31, 2014

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

(d) Prepare the journal entry to record the interest payment and the amortization for 2016. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

December 31, 2016

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

Answers: 3

Another question on Business

Business, 22.06.2019 01:00

How does the economy of cuba differ from the economy of north korea? in north korea, the government’s control of the economy has begun to loosen. in cuba, the government maintains a tight hold over the economy. in cuba, the government’s control of the economy has begun to loosen. in north korea, the government maintains a tight hold over the economy. in north korea, there is economic uncertainty in exchange for individual choice. in cuba, there is economic security in exchange for government control. in cuba, there is economic uncertainty in exchange for individual choice. in north korea, there is economic security in exchange for government control.\

Answers: 2

Business, 22.06.2019 16:00

Analyzing and computing accrued warranty liability and expense waymire company sells a motor that carries a 60-day unconditional warranty against product failure. from prior years' experience, waymire estimates that 2% of units sold each period will require repair at an average cost of $100 per unit. during the current period, waymire sold 69,000 units and repaired 1,000 units. (a) how much warranty expense must waymire report in its current period income statement? (b) what warranty liability related to current period sales will waymire report on its current period-end balance sheet? (hint: remember that some units were repaired in the current period.) (c) what analysis issues must we consider with respect to reported warranty liabilities?

Answers: 1

Business, 22.06.2019 17:10

To : of $25 up to 35 2 35 up to 45 5 45 up to 55 7 55 up to 65 20 65 up to 75 16 is$25 up to $35 ?

Answers: 1

You know the right answer?

On January 1, 2014, Aumont Company sold 12% bonds having a maturity value of $500,000 for $537,907,...

Questions

Social Studies, 22.03.2021 21:00

SAT, 22.03.2021 21:00

Mathematics, 22.03.2021 21:00

Mathematics, 22.03.2021 21:00

Mathematics, 22.03.2021 21:00

English, 22.03.2021 21:00

Spanish, 22.03.2021 21:00

Mathematics, 22.03.2021 21:00

Mathematics, 22.03.2021 21:00

English, 22.03.2021 21:00

Physics, 22.03.2021 21:00