Business, 22.02.2020 03:32 adanamador8807

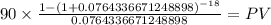

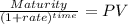

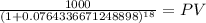

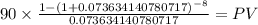

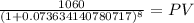

Purple Whale Foodstuffs Inc. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $1130.35. However, Purple Whale Foodstuffs Inc. may call the bonds in eight years at a call price of $1,060.

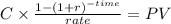

1. What is the TYM? -options: 8.55%, 7.09%, 9.59%, 7.64%

2. What is the YTC? -options: 7.36%, 9.59%, 7.64%, 6.47%

3. If interest rates are expected to remain constant, what is the best estimate of the remaining life left for RTE Incs bonds? -options: 8 yrs, 5 yrs, 13 yrs, 10 yrs

4. If RTE issued new bonds today, what coupon rate must have to be issued at par? -options: 8.32%, 7.64%, 7.09%, 9.59%

Answers: 1

Another question on Business

Business, 22.06.2019 14:30

You hear your supervisor tell another supervisor that a fire drill will take place later today when the fire alarm sounds that afternoon you should

Answers: 1

Business, 22.06.2019 15:30

University hero is considering expanding operations beyond its healthy sandwiches. jim axelrod, vice president of marketing, would like to add a line of smoothies with a similar health emphasis. each smoothie would include two free health supplements such as vitamins, antioxidants, and protein. jim believes smoothie sales should fill the slow mid-afternoon period. adding the line of smoothies would require purchasing additional freezer space, machinery, and equipment. jim provides the following projections of net sales, net income, and average total assets in support of his proposal. sandwichesonly sandwiches and smoothies net sales $ 750,000 $ 1,350,000 net income 120,000 210,000 average total assets 350,000 750,000 return on assetschoose numerator ÷ choose denominator = return on assets÷ = return on assets÷ = profit margin÷ = profit margin÷ = asset turnover÷ = asset turnover÷ = times

Answers: 2

Business, 22.06.2019 17:00

Dan wants to start a supermarket in his hometown, and wants to get into the business only after finding out about the market and how successful his business might be. the best way for dan to gain knowledge is to:

Answers: 2

Business, 22.06.2019 23:10

Amazon inc. does not currently pay a dividend. analysts expect amazon to commence paying annual dividends in three years. the first dividend is expected to be $2 per share. dividends are expected to grow from that point at an annual rate of 4% in perpetuity. investors expect a 12% return from the stock. what should the price of the stock be today?

Answers: 1

You know the right answer?

Purple Whale Foodstuffs Inc. has 9% annual coupon bonds that are callable and have 18 years left unt...

Questions

Biology, 31.07.2019 20:30

History, 31.07.2019 20:30

History, 31.07.2019 20:30

World Languages, 31.07.2019 20:30

Social Studies, 31.07.2019 20:30

English, 31.07.2019 20:30