Answers: 3

Another question on Business

Business, 21.06.2019 20:30

Resources that are valuable but not rare can be categorized asanswers: organizational weaknesses.distinctive competencies.organizational strengths.complementary resources and capabilities.

Answers: 1

Business, 22.06.2019 09:00

You speak to a business owner that is taking in almost $2000 in revenue each month. the owner still says that they are having trouble keeping the doors open. how can that be possible? use the terms of revenue, expenses and profit/loss in your answer

Answers: 3

Business, 22.06.2019 11:30

Which of the following is not an example of one of the four mail advantages of prices on a free market economy

Answers: 1

Business, 22.06.2019 11:40

Fanning company is considering the addition of a new product to its cosmetics line. the company has three distinctly different options: a skin cream, a bath oil, or a hair coloring gel. relevant information and budgeted annual income statements for each of the products follow. skin cream bath oil color gel budgeted sales in units (a) 110,000 190,000 70,000 expected sales price (b) $8 $4 $11 variable costs per unit (c) $2 $2 $7 income statements sales revenue (a × b) $880,000 $760,000 $770,000 variable costs (a × c) (220,000) (380,000) (490,000) contribution margin 660,000 380,000 280,000 fixed costs (432,000) (240,000) (76,000) net income $228,000 $140,000 $204,000 required: (a) determine the margin of safety as a percentage for each product. (b) prepare revised income statements for each product, assuming a 20 percent increase in the budgeted sales volume. (c) for each product, determine the percentage change in net income that results from the 20 percent increase in sales. (d) assuming that management is pessimistic and risk averse, which product should the company add to its cosmetics line? (e) assuming that management is optimistic and risk aggressive, which product should the company add to its cosmetics line?

Answers: 1

You know the right answer?

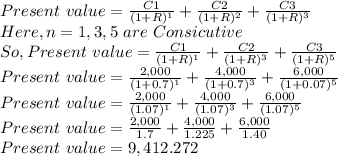

You will be receiving cash flows of: $1,000 today, $2,000 at end of year 1, $4,000 at end of year

Questions

English, 23.09.2021 06:10

Mathematics, 23.09.2021 06:10

English, 23.09.2021 06:10

Mathematics, 23.09.2021 06:10

Mathematics, 23.09.2021 06:10

Mathematics, 23.09.2021 06:10

Biology, 23.09.2021 06:20