1. Emilio earns $150 per week plus 38% commission. He sells $1043.92 in one

week, what is his...

Business, 25.02.2020 18:54 clashofclans17

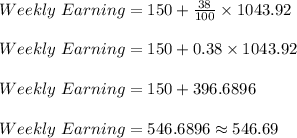

1. Emilio earns $150 per week plus 38% commission. He sells $1043.92 in one

week, what is his gross weekly earning.

Answers: 3

Another question on Business

Business, 22.06.2019 04:00

Medtronic, inc., is a medical technology company that competes for customers with st. jude medical s.c., inc. james hughes worked for medtronic as a sales manager. his contract prohibited him from working for a competitor for one year after leaving medtronic. hughes sought a position as a sales director for st. jude. st. jude told hughes that his contract with medtronic was unenforceable and offered him a job. hughes accepted. medtronic filed a suit, alleging wrongful interference. which type of interference was most likely the basis for this suit? did it occur here? medtronic, inc., is a medical technology company that competes for customers with st. jude medical s.c., inc. james hughes worked for medtronic as a sales manager. his contract prohibited him from working for a competitor for one year after leaving medtronic

Answers: 2

Business, 22.06.2019 07:40

Xyz corporation has provided the following data concerning manufacturing overhead for july: actual manufacturing overhead incurred $ 69,000 manufacturing overhead applied to work in process $ 79,000 the company's cost of goods sold was $243,000 prior to closing out its manufacturing overhead account. the company closes out its manufacturing overhead account to cost of goods sold. which of the following statements is true? multiple choice manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000

Answers: 1

Business, 22.06.2019 12:50

You own 2,200 shares of deltona hardware. the company has stated that it plans on issuing a dividend of $0.42 a share at the end of this year and then issuing a final liquidating dividend of $2.90 a share at the end of next year. your required rate of return on this security is 16 percent. ignoring taxes, what is the value of one share of this stock to you today?

Answers: 1

Business, 22.06.2019 14:00

How many months does the federal budget usually take to prepare

Answers: 1

You know the right answer?

Questions

Mathematics, 13.11.2020 01:00

Social Studies, 13.11.2020 01:00

Computers and Technology, 13.11.2020 01:00

Physics, 13.11.2020 01:00

English, 13.11.2020 01:00

Engineering, 13.11.2020 01:00

Mathematics, 13.11.2020 01:00

Mathematics, 13.11.2020 01:00

Social Studies, 13.11.2020 01:00

Social Studies, 13.11.2020 01:00

Mathematics, 13.11.2020 01:00