In addition to cash contributions to charity, Dean decided to donate shares of stock and a portrait painted during the earlier part of the last century. Dean purchased the stock and the portrait many years ago as investments. Dean reported the following recipients:

Charity Property Cost FMV

State University Cash $15,000 $15,000

Red Cross Cash 14,500 14,500

State History Museum Painting 5,000 82,000

City Medical Center Dell stock 28,000 17,000

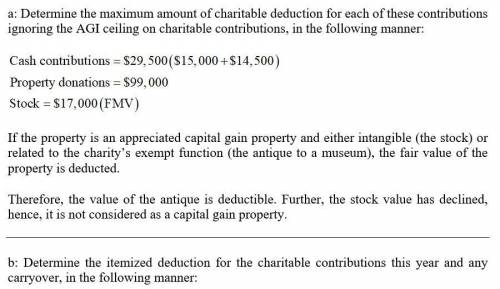

a. Determine the maximum amount of charitable deduction for each of these contributions ignoring the AGI ceiling on charitable contributions.

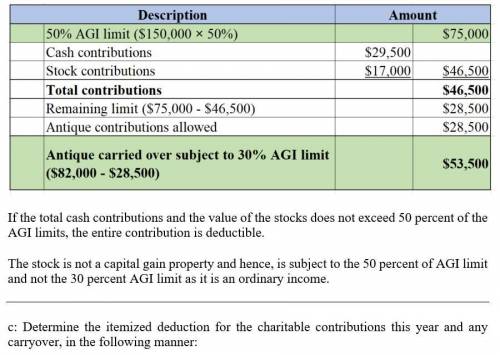

b. Assume that Dean’s AGI this year is $150,000. Determine Dean’s itemized deduction for his charitable contributions this year and any carryover.

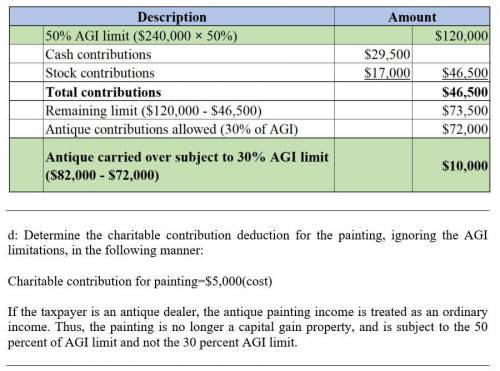

c. Assume that Dean’s AGI this year is $240,000. Determine Dean’s itemized deduction for his charitable contributions this year and any carryover.

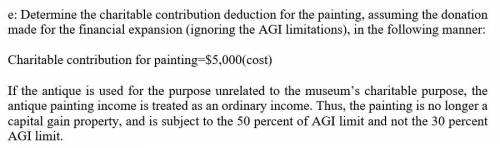

d. Suppose Dean is a dealer in antique paintings and had held the painting for sale before the contribution. What is Dean's charitable contribution deduction for the antique painting in this situation (ignoring AGI limitations)?

e. Suppose that Dean’s objective with the donation to the museum was to finance expansion of the historical collection. Hence, Dean was not surprised when the museum announced the sale of the portrait because of its limited historical value. What is Dean's charitable contribution deduction for the paintings in this situation (ignoring AGI limitations)?

Answers: 1

Another question on Business

Business, 22.06.2019 05:20

Carmen co. can further process product j to produce product d. product j is currently selling for $20 per pound and costs $15.75 per pound to produce. product d would sell for $38 per pound and would require an additional cost of $8.55 per pound to produce. what is the differential revenue of producing product d?

Answers: 2

Business, 22.06.2019 06:30

Ummit record company is negotiating with two banks for a $157,000 loan. fidelity bank requires a compensating balance of 24 percent, discounts the loan, and wants to be paid back in four quarterly payments. southwest bank requires a compensating balance of 12 percent, does not discount the loan, but wants to be paid back in 12 monthly installments. the stated rate for both banks is 9 percent. compensating balances will be subtracted from the $157,000 in determining the available funds in part a. a-1. calculate the effective interest rate for fidelity bank and southwest bank. (do not round intermediate calculations. input your answers as a percent rounded to 2 decimal places.) a-2. which loan should summit accept? southwest bank fidelity bank b. recompute the effective cost of interest, assuming that summit ordinarily maintains $37,680 at each bank in deposits that will serve as compensating balances

Answers: 1

Business, 22.06.2019 08:00

Suppose the number of equipment sales and service contracts that a store sold during the last six (6) months for treadmills and exercise bikes was as follows: treadmill exercise bike total sold 185 123 service contracts 67 55 the store can only sell a service contract on a new piece of equipment. of the 185 treadmills sold, 67 included a service contract and 118 did not.

Answers: 1

Business, 22.06.2019 21:30

Abond purchased for $950 was sold for $980 after one year. the interest received during the year is $25. the bond's yield is:

Answers: 1

You know the right answer?

In addition to cash contributions to charity, Dean decided to donate shares of stock and a portrait...

Questions

Mathematics, 17.06.2021 22:10

Chemistry, 17.06.2021 22:10

Chemistry, 17.06.2021 22:10

Mathematics, 17.06.2021 22:20

Mathematics, 17.06.2021 22:20

Mathematics, 17.06.2021 22:20

Mathematics, 17.06.2021 22:20

Computers and Technology, 17.06.2021 22:20

Health, 17.06.2021 22:20

Mathematics, 17.06.2021 22:20