Business, 27.02.2020 04:33 LaneyMM1401

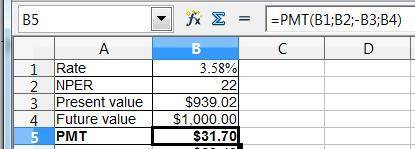

A bond has yield to maturity of 7.15 percent; face value of $1,000; time to maturity of 11 years and pays coupons semiannually. If the price of the bond is $939.02, calculate the coupon rate of the bond.

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Suppose the price of a complement to lcd televisions rises. what effect will this have on the market equilibrium for lcd tvs?

Answers: 1

Business, 22.06.2019 06:20

At a small store, a customer enters the front door on average every 8 minutes. a prior study indicated that the time between customers entering the front door during weekdays follows an exponential distribution. what is the probability that the time between customers entering the store on a weekday will be less than or equal to 7? select one: a. 62 b. 43 c. 1/8 d. 7/8 e. 58

Answers: 1

Business, 22.06.2019 17:00

Aaron corporation, which has only one product, has provided the following data concerning its most recent month of operations: selling price $ 102 units in beginning inventory 0 units produced 4,900 units sold 4,260 units in ending inventory 640 variable costs per unit: direct materials $ 20 direct labor $ 41 variable manufacturing overhead $ 5 variable selling and administrative expense $ 4 fixed costs: fixed manufacturing overhead $ 64,200 fixed selling and administrative expense $ 2,900 the total contribution margin for the month under variable costing is:

Answers: 2

Business, 22.06.2019 18:00

Large public water and sewer companies often become monopolies because they benefit from although the company faces high start-up costs, the firm experiences average production costs as it expands and adds more customers. smaller competitors would experience average costs and would be less

Answers: 1

You know the right answer?

A bond has yield to maturity of 7.15 percent; face value of $1,000; time to maturity of 11 years and...

Questions

Social Studies, 17.03.2020 23:21

Mathematics, 17.03.2020 23:21

Mathematics, 17.03.2020 23:21

Physics, 17.03.2020 23:21

Spanish, 17.03.2020 23:21

Chemistry, 17.03.2020 23:21