Business, 27.02.2020 17:38 aiguillen6228

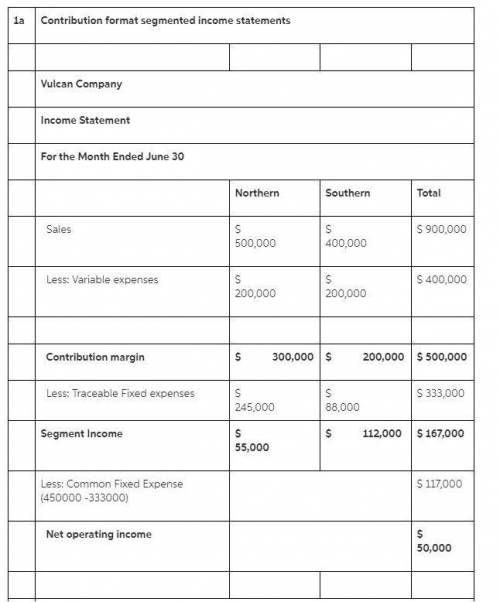

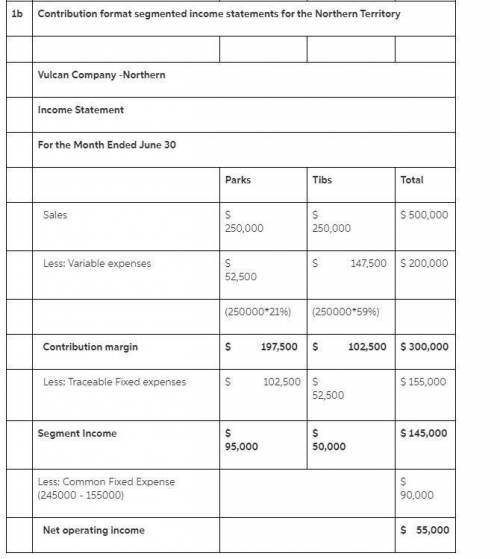

Vulcan Company’s contribution format income statement for June is given below: Vulcan CompanyIncome StatementFor the Month Ended June 30 Sales $ 900,000 Variable expenses 400,000 Contribution margin 500,000 Fixed expenses 450,000 Net operating income $ 50,000 Management is disappointed with the company’s performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following: a. The company is divided into two sales territories—Northern and Southern. The Northern Territory recorded $500,000 in sales and $200,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $245,000 and $88,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products—Paks and Tibs. Sales of Paks and Tibs totaled $250,000 and $250,000, respectively, in the Northern territory during June. Variable expenses are 21% of the selling price for Paks and 59% for Tibs. Cost records show that $102,500 of the Northern Territory’s fixed expenses are traceable to Paks and $52,500 to Tibs, with the remainder common to the two products. Required:1a. Prepare contribution format segmented income statements for the total company broken down between sales territories.1b. Prepare contribution format segmented income statements for the Northern Territory broken down by product line.

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

Resources and capabilities, such as interpersonal relations among managers and a firm's culture, that may be costly to imitate because they are beyond the ability of firms to systematically manage and influence are referred to asanswers: socially complex.causally ambiguous.path dependent.the result of unique historical conditions.

Answers: 3

Business, 22.06.2019 02:30

Atax on the sellers of coffee will a. increase the price of coffee paid by buyers, increase the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee. b. increase the price of coffee paid by buyers, increase the e ffective price of coffee received by sellers, and decrease the equilibrium quantity of coffee. c. increase the price of coffee paid by buyers, decrease the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee. d. increa se the price of coffee paid by buyers, decrease the effective price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

Answers: 3

Business, 22.06.2019 18:10

During the year, the delph company had no beginning or ending inventories and it started, completed, and sold only two jobs—job d-75 and job c-100. it provided the following information related to those two jobs: job d-75: molding fabrication total direct materials cost $ 375,000 $ 325,000 $ 700,000 direct labor cost $ 200,000 $ 160,000 $ 360,000 machine-hours 15,000 5,000 20,000 job c-100: molding fabrication total direct materials cost $ 300,000 $ 250,000 $ 550,000 direct labor cost $ 175,000 $ 225,000 $ 400,000 machine-hours 5,000 25,000 30,000delph had no overapplied or underapplied manufacturing overhead during the year. assume delph uses a plantwide overhead rate based on machine-hours.1-a. compute the predetermined plantwide overhead rate.1-b. compute the total manufacturing costs assigned to job d-70 and job c-200.1-c. if delph establishes bid prices that are 150% of total manufacturing costs, what bid price would it have established for job d-70 and job c-200? 1-d. what is delph's cost of goods sold for the year? assume delph uses departmental overhead rates based on machine-hours.2-a. compute the predetermined departmental overhead rates.2-b. compute the total manufacturing costs assigned to job d-70 and job c-200.2-c. if delph establishes bid prices that are 150% of total manufacturing costs, what bid price would it have established for job d-70 and job c-200? 2-d. what is delph's cost of goods sold for the year?

Answers: 3

Business, 22.06.2019 19:10

Pam is a low-risk careful driver and fran is a high-risk aggressive driver. to reveal their driver types, an auto-insurance company a. refuses to insure high-risk drivers b. charges a higher premium to owners of newer cars than to owners of older cars c. offers policies that enable drivers to reveal their private information d. uses a pooling equilibrium e. requires drivers to categorize themselves as high-risk or low-risk on the application form

Answers: 3

You know the right answer?

Vulcan Company’s contribution format income statement for June is given below: Vulcan CompanyIncome...

Questions

Mathematics, 04.01.2020 23:31

Mathematics, 04.01.2020 23:31

History, 04.01.2020 23:31

Geography, 04.01.2020 23:31

Biology, 04.01.2020 23:31

Mathematics, 04.01.2020 23:31

History, 04.01.2020 23:31

History, 04.01.2020 23:31

Business, 04.01.2020 23:31