Business, 27.02.2020 22:54 kokilavani

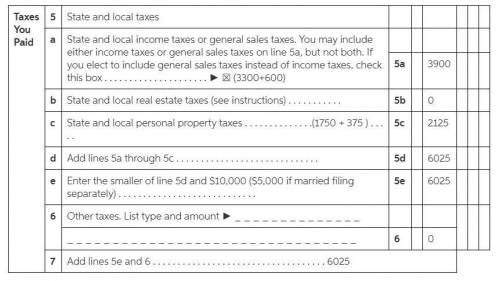

Laura is a single taxpayer living in New Jersey with adjusted gross income for the 2019 tax year of $35,550. Laura's employer withheld $3,410 in state income tax from her salary. In April of 2019, she pays $550 in additional state taxes for her prior year's tax return. The real estate taxes on her home are $1,800 for 2019, and her personal property taxes, based on the value of the property, amount to $400. Also, she paid $80 for state gasoline taxes for the year.

Prepare the taxes section to report Laura's 2018 deduction for taxes assuming she chooses to deduct state and local income taxes.

Answers: 1

Another question on Business

Business, 21.06.2019 14:20

Food, water, and shelter will not attract insects and rodents if recyclables are stored in

Answers: 3

Business, 21.06.2019 16:30

]4. seiler company has the following information: materials work-in-process finished goods beginning inventory 300 400 500 ending inventory 700 900 1500 material purchase 7,700 cost of goods sold 15,600 direct labor 5,500 what was the manufacturing overhead for the period? a. $3,400. b. $4,300. c. $3,000. d. $5,500.

Answers: 2

Business, 21.06.2019 20:30

Max fischer is a beekeeper. his annual group insurance costs 11,700. his employer pays 60% of the cost. how much does max pay semimonthly for it?

Answers: 1

Business, 21.06.2019 22:30

What two elements normally must exist before a person can be held liable for a crime

Answers: 1

You know the right answer?

Laura is a single taxpayer living in New Jersey with adjusted gross income for the 2019 tax year of...

Questions

Physics, 01.12.2021 04:00

Health, 01.12.2021 04:00

SAT, 01.12.2021 04:00

Mathematics, 01.12.2021 04:00

Mathematics, 01.12.2021 04:10

Business, 01.12.2021 04:10

History, 01.12.2021 04:10

Mathematics, 01.12.2021 04:10