Business, 28.02.2020 19:35 shay03littletop5kx2p

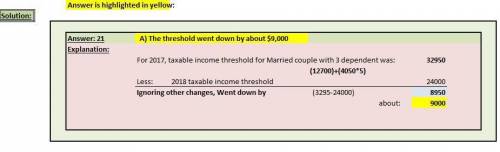

The Tax Cuts and Jobs Act passed in December, 2017, eliminated any personal exemptions ($4,050 per preson) but increased the standard deduction to $12,000 for single filers and $24,000 for joint filers beginning in 2018 compared to $6,350 and $12,700 respectively in 2017. Ignoring any other changes made by the new tax law (and there are other important changes such as expansion of a child tax credit), what would the threshold for having any taxable income for a family of two adults and three dependent children be in 2018 compared to 2017? (Hint: the threshold in 2017 was the standard deduction for a married couple with five personal exemptions.)

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

What do economists mean when they use the latin expression ceteris paribus?

Answers: 3

Business, 22.06.2019 05:30

The hartman family is saving $400 monthly for ronald's college education. the family anticipates they will need to contribute $20,000 towards his first year of college, which is in 4 years .which best explain s whether the family will have enough money in 4 years ?

Answers: 1

Business, 22.06.2019 18:50

Retirement investment advisors, inc., has just offered you an annual interest rate of 4.4 percent until you retire in 40 years. you believe that interest rates will increase over the next year and you would be offered 5 percent per year one year from today. if you plan to deposit $13,000 into the account either this year or next year, how much more will you have when you retire if you wait one year to make your deposit?

Answers: 3

Business, 23.06.2019 01:00

"consists of larger societal forces that affect how a company engages and serves its customers."

Answers: 1

You know the right answer?

The Tax Cuts and Jobs Act passed in December, 2017, eliminated any personal exemptions ($4,050 per p...

Questions

Business, 15.02.2021 22:20

History, 15.02.2021 22:20

Mathematics, 15.02.2021 22:20

Mathematics, 15.02.2021 22:20

English, 15.02.2021 22:20

Mathematics, 15.02.2021 22:20

French, 15.02.2021 22:20

Mathematics, 15.02.2021 22:20