Business, 28.02.2020 21:55 dudejustdont

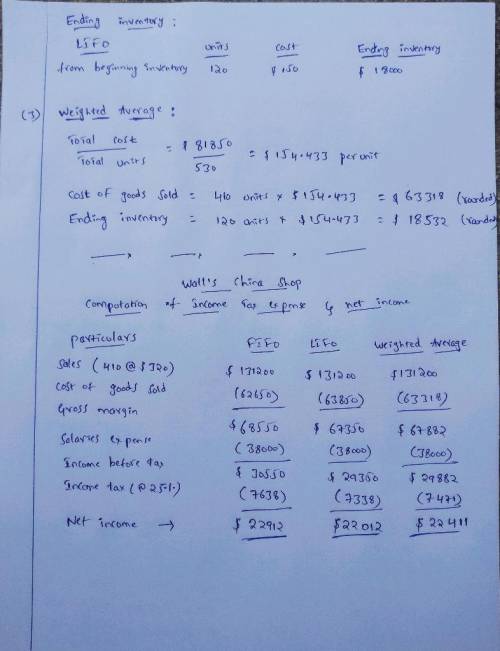

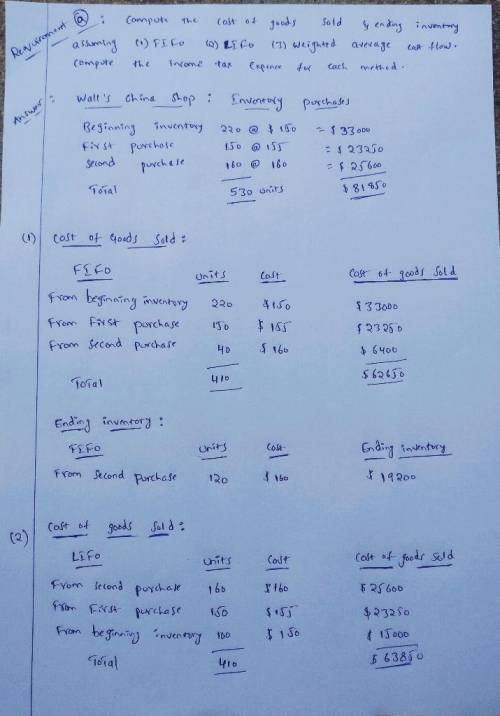

Problem 5-19A Effect of different inventory cost flow methods on financial statements LO 5-1 The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash $ 80,100 Beginning inventory 33,000 (220 units @ $150) Common stock 50,000 Retained earnings 63,100 The following five transactions occurred in Year 2: First purchase (cash) 150 units @ $155 Second purchase (cash) 160 units @ $160 Sales (all cash): 410 units @ $320 Paid $38,000 cash for salaries expense Paid cash for income tax at the rate of 25 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. Compute the income tax expense for each method. b. Record the above transactions in general journal form and post to T-accounts assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. Assume perpetual inventory system is used. 1. FIFO 2. LIFO 3. Weighted Average c. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average.

Answers: 2

Another question on Business

Business, 22.06.2019 18:00

1. what is the amount of interest earned after two years on a $100 deposit paying 4 percent simple interest annually? $8.00 $4.08 $8.16 $4.00 2. what is the amount of compound interest earned after three years on a $100 deposit paying 8 percent interest annually? $24.00 $8.00 $16.64 $25.97 3. a business just took out a loan for $100,000 at 10% interest. if the business pays the loan off in three months, how much did the business pay in interest? $2,500.00 $10.00 $250.00 $10,000.00 4. what is the annual percentage yield (apy) for a deposit paying 5 percent interest with monthly compounding? 5.00% 5.12% 79.59% 0.42%

Answers: 1

Business, 22.06.2019 21:10

Which statement or statements are implied by equilibrium conditions of the loanable funds market? a firm borrowing in the loanable funds market invests those funds with a higher expected return than any firm that is not borrowing. investment projects which use borrowed funds are guaranteed to be profitable even after paying interest expenses. the quantity of savings is maximized, thus the quantity of investment is maximized. a loan is made at the minimum interest rate of all current borrowing.

Answers: 3

Business, 23.06.2019 01:50

The partnership of douglas, ryan, and ellen has dissolved and is in the process of liquidation. on july 1, 2016, just before the second cash distribution, the assets and equities of the partnership along with profit and loss sharing ratios were as follows: cash $30,000receivable - net $20,000inventories $25,000equipment - net $30,000total assets $80,000liabilities $12,000douglas, capital (20%) $28,000ryan, capital (50%) $24,000ellen, capital (30%) $16,000total liab./equity $80,000assume that the available cash is distributed immediately, except for a $2,000 contingency fund that is withheld pending complete liquidation of the partnership. how much cash should be paid to each of the partners? a. $3,200 douglas, $8,000 ryan, $4,800 ellenb. $5,600 douglas, $14,000 ryan, $8,400 ellenc. $16,000 douglas, $0 ryan, $0 ellend. $8,000 douglas, $0 ryan, $8,000 ellen

Answers: 1

Business, 23.06.2019 02:40

Peter, the marketing manager of a company that manufactures church furniture, has been given the job of increasing corporate profits by five percent during the upcoming year. peter decided to give his assistant the full responsibility and authority for developing a mailing campaign to target churches in an entire state. in other words, peter has

Answers: 1

You know the right answer?

Problem 5-19A Effect of different inventory cost flow methods on financial statements LO 5-1 The acc...

Questions

Mathematics, 13.05.2021 21:30

Chemistry, 13.05.2021 21:30

Geography, 13.05.2021 21:30

Mathematics, 13.05.2021 21:30

Mathematics, 13.05.2021 21:30

Mathematics, 13.05.2021 21:30

Computers and Technology, 13.05.2021 21:30

Mathematics, 13.05.2021 21:30

History, 13.05.2021 21:30

Mathematics, 13.05.2021 21:30

Mathematics, 13.05.2021 21:30