Business, 02.03.2020 17:05 hnsanders00

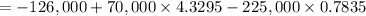

Consider a one-year project that costs $126,000, provides an income of $70,000 a year for 5 years, and costs $225,000 to dispose of at the very end of the fifth year. Assume that the first payment comes at the start of the year after the project is undertaken. Should the project be undertaken at a 0% discount rate? How about 2%? 5%? 10%? (HINT: To answers these questions use the present discounted value)

Answers: 3

Another question on Business

Business, 22.06.2019 05:30

Suppose jamal purchases a pair of running shoes online for $60. if his state has a sales tax on clothing of 6 percent, how much is he required to pay in state sales tax?

Answers: 3

Business, 22.06.2019 12:20

Selected transactions of the carolina company are listed below. classify each transaction as either an operating activity, an investing activity, a financing activity, or a noncash activity. 1. common stock is sold for cash above par value. 2. bonds payable are issued for cash at a discount

Answers: 2

Business, 22.06.2019 20:00

If a hotel has 100 rooms, and each room takes 25 minutes to clean, how many housekeepers working 8-hour shifts does the hotel need at 50 percent occupancy?

Answers: 1

Business, 22.06.2019 21:20

What business practice contributed most to andrew carnegie’s ability to form a monopoly?

Answers: 1

You know the right answer?

Consider a one-year project that costs $126,000, provides an income of $70,000 a year for 5 years, a...

Questions

English, 05.05.2020 03:06

Mathematics, 05.05.2020 03:06

History, 05.05.2020 03:06

Mathematics, 05.05.2020 03:06

English, 05.05.2020 03:06

Biology, 05.05.2020 03:06

Mathematics, 05.05.2020 03:06

Mathematics, 05.05.2020 03:06

English, 05.05.2020 03:06

History, 05.05.2020 03:06

Mathematics, 05.05.2020 03:06