LANSBURY INC.

Lansbury Inc. had the following balance sheet at December 31, 2019.

LANSBURY INC.

BALANCE SHEET

DECEMBER 31, 2019

Cash $20,000 Accounts payable $30,000

Accounts receivable 21,200 Notes payable (long-term) 41,000

Investments 32,000 Common stock 100,000

Plant assets (net) 81,000 Retained earnings 23,200

Land 40,000 $194,200

$194,200

During 2020, the following occurred.

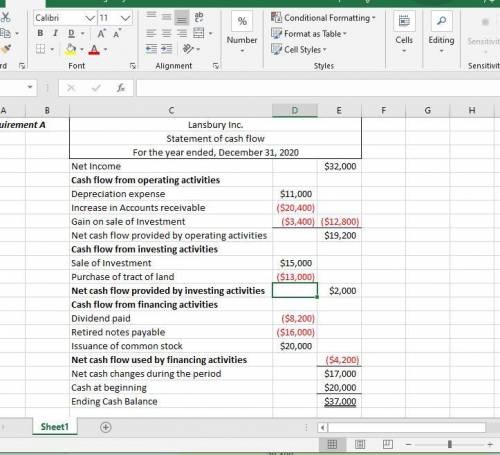

1. Lansbury Inc. sold part of its debt investment portfolio for $15,000. This transaction resulted in a gain of $3,400 for the firm. The company classifies these investments as available-for-sale.

2. A tract of land was purchased for $13,000 cash.

3. Long-term notes payable in the amount of $16,000 were retired before maturity by paying $16,000 cash.

4. An additional $20,000 in common stock was issued at par.

5. Dividends of $8,200 were declared and paid to stockholders.

6. Net income for 2020 was $32,000 after allowing for depreciation of $11,000.

7. Land was purchased through the issuance of $35,000 in bonds.

8. At December 31, 2020, Cash was $37,000, Accounts Receivable was $41,600, and Accounts Payable remained at $30,000.

Requried:

a. Prepare a statement of cash flows for 2017.

b. Prepare an unclassified balance sheet as it would appear on December 31, 2017.

c. Compute two cash flow ratios.

Answers: 3

Another question on Business

Business, 22.06.2019 07:30

Why has the free enterprise system been modified to include some government intervention?

Answers: 1

Business, 22.06.2019 17:10

Storico co. just paid a dividend of $3.15 per share. the company will increase its dividend by 20 percent next year and then reduce its dividend growth rate by 5 percentage points per year until it reaches the industry average of 5 percent dividend growth, after which the company will keep a constant growth rate forever. if the required return on the company’s stock is 12 percent, what will a share of stock sell for today?

Answers: 1

Business, 22.06.2019 19:00

It is estimated that over 100,000 students will apply to the top 30 m.b.a. programs in the united states this year. a. using the concept of net present value and opportunity cost, when is it rational for an individual to pursue an m.b.a. degree. b. what would you expect to happen to the number of applicants if the starting salaries of managers with m.b.a. degrees remained constant but salaries of managers without such degrees decreased by 20 percent

Answers: 3

Business, 22.06.2019 20:20

John has served as the chief operating officer (coo) for business graphics, inc., a publicly owned firm, the past 5 years. which of the following statements about john is correct? both john and the ceo of business graphics must certify to the sec that the firm's financial statements are accurate. as the coo, john will be ranked higher than the ceo but still below the cfo. in john's postition as the coo, it is highly unlikely that he would also be the chairperson of the board of directors. as the coo, john would typically be involved with accounting, finance, and asset purchase decisions.

Answers: 2

You know the right answer?

Lansbury Inc. had the following balance sheet at December 31, 2019.

LANSBURY INC.

LANSBURY INC.

Questions

Mathematics, 04.01.2020 20:31

Mathematics, 04.01.2020 20:31

Physics, 04.01.2020 20:31

Mathematics, 04.01.2020 20:31

Mathematics, 04.01.2020 20:31

Chemistry, 04.01.2020 21:31

Mathematics, 04.01.2020 21:31