Business, 03.03.2020 00:24 issagirl05

Land in the Marcellus Shale natural gas play is currently leasing for $10,000 per acre. 100 acres are needed in order to drill for natural gas. Leases last for three years, and if no drilling occurs within those three years then the land goes back on the market. In other words, if a lease is signed in Year 0, then the company holding the lease must drill and complete a well in Year 0, Year 1 or Year 2. If this does not happen then the lease expires at the end of Year 2 and that parcel of land can be re-leased.

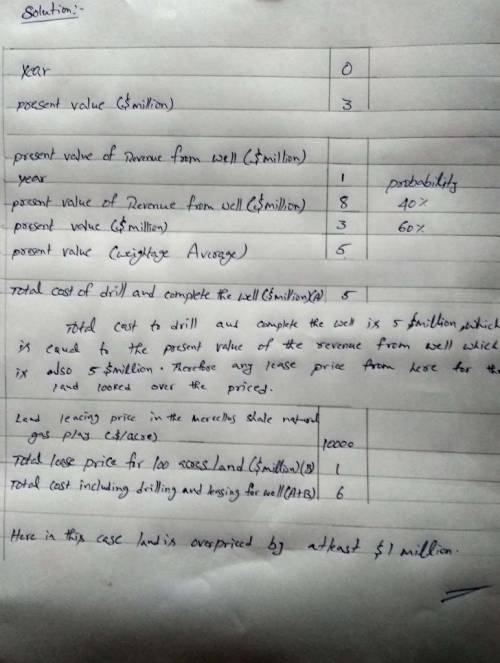

The cost to drill and complete a well is $5 million, incurred entirely in the year in which the well is drilled. There are no other operating costs to extract natural gas other than the drilling and completion. Currently (in Year 0), the present value of the revenues from the gas well are $3 million. Each year, there is a 40% probability that the present value of revenues will go up to $8 million for a well drilled in that year, and a 60% probability that the present value of revenues will be $3 million for a well drilled in that year.

Calculate the value of a 100 acre parcel of land in the current year (Year 0). Remember that leasing in Year 0 gives you the option to drill in Year 0, Year 1 or Year 2. Also remember that to calculate the value of the land you need to make a comparison with a scenario where you lease the land in Year 0 and are committed to drilling in Year 0. Does land appear to be over-priced, under-priced, or priced correctly? Please use a 10% discount rate per year.

Answers: 1

Another question on Business

Business, 22.06.2019 22:40

Which of the following will not cause the consumption schedule to shift? a) a sharp increase in the amount of wealth held by households b) a change in consumer incomes c) the expectation of a recession d) a growing expectation that consumer durables will be in short supply

Answers: 1

Business, 22.06.2019 23:00

You cannot make copies of media, even as a personal backup, without violating copyright. true

Answers: 3

Business, 22.06.2019 23:50

Jaguar has full manufacturing costs of their s-type sedan of £22,803. they sell the s-type in the uk with a 20% margin for a price of £27,363. today these cars are available in the us for $55,000 which is the uk price multiplied by the current exchange rate of $2.01/£. jaguar has committed to keeping the us price at $55,000 for the next six months. if the uk pound appreciates against the usd to an exchange rate of $2.15/£, and jaguar has not hedged against currency changes, what is the amount the company will receive in pounds at the new exchange rate?

Answers: 1

Business, 23.06.2019 01:40

The petty cash fund has a current balance of $ 350, which is the established fund balance. based on activity in the fund, it is determined that the balance needs to be changed to $ 450. which journal entry is needed to make this change?

Answers: 3

You know the right answer?

Land in the Marcellus Shale natural gas play is currently leasing for $10,000 per acre. 100 acres ar...

Questions

History, 08.04.2020 03:14

History, 08.04.2020 03:14

Mathematics, 08.04.2020 03:14

Mathematics, 08.04.2020 03:14

Biology, 08.04.2020 03:14

History, 08.04.2020 03:14

English, 08.04.2020 03:15