Business, 03.03.2020 04:29 bettinger6525

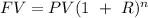

The principal of the time value of money is probably the single most important concept in financial management. One of the most frequently encountered applications involves the calculation of a future value.

The process for converting present values into future values is called .This process requires knowledge of the values of three of four time-value-of-money variables. Which of the following is not one of these variables?

a. The interest rate (I) that could be earned by deposited funds

b. The duration of the deposit (N)

c. The trend between the present and future values of an investment

d. The present value (PV) of the amount deposited

Answers: 3

Another question on Business

Business, 22.06.2019 16:50

Andrea cujoli is a currency speculator who enjoys "betting" on changes in the foreign currency exchange market. currently the spot price for the japanese yen is ¥129.87/$ and the 6-month forward rate is ¥128.53/$. andrea would earn a higher rate of return by buying yen and a forward contract than if she had invested her money in 6-month us treasury securities at an annual rate of 2.50%. true/false?

Answers: 2

Business, 22.06.2019 17:00

Vincent is interested in increasing his earning potential upon completing his internship at a major accounting firm. which option can immediately boost his career in the intended direction? b. complete a certification from a professional organization c. complete a new four-year undergraduate program in a related field d. complete a two-year associate degree in a related field e. complete an online course in accounting

Answers: 3

Business, 22.06.2019 22:20

Which of the following is one disadvantage of renting a place to live compared to buying a home? a. tenants have to pay for all repairs to the building. b. the landlord covers the expenses of maintaining the property. c. residents can't alter their living space without permission. d. rent is generally more than monthly mortgage payments.

Answers: 1

Business, 23.06.2019 01:50

Mart's boutique has sales of $820,000 and costs of $540,000. interest expense is $36,000 and depreciation is $59,000. the tax rate is 21 percent. what is the net income? $146,150 221,200 105,000 139,050

Answers: 3

You know the right answer?

The principal of the time value of money is probably the single most important concept in financial...

Questions

Social Studies, 28.08.2019 03:30

History, 28.08.2019 03:30

History, 28.08.2019 03:30

Mathematics, 28.08.2019 03:30

Biology, 28.08.2019 03:30

Mathematics, 28.08.2019 03:30

Mathematics, 28.08.2019 03:30

History, 28.08.2019 03:30

Mathematics, 28.08.2019 03:30

Biology, 28.08.2019 03:30