Answers: 3

Another question on Business

Business, 21.06.2019 23:00

Employees of dti, inc. worked 1,600 direct labor hours in january and 1,000 direct labor hours in february. dti expects to use 18,000 direct labor hours during the year, and expects to incur $22,500 of worker’s compensation insurance cost for the year. the cash payment for this cost will be paid in april. how much insurance premium should be allocated to products made in january and february?

Answers: 1

Business, 22.06.2019 07:30

Select the correct answer the smith family adopted a child. the adoption procedure took about three months, and the family incurred various expenses. will the smiths receive and financial benefit for the taxable year? a) they will not receive any financial benefit for adopting the child b) their income tax component will decrease c) they will receive childcare grants d) they will receive a tax credit for the cost borne for adopting the child e) they will receive several tax deductions

Answers: 3

Business, 22.06.2019 10:40

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: asset a e(ra) = 18.5% σa = 20% asset b e(rb) = 15% σb = 27% an investor with a risk aversion of a = 3 would find that on a risk-return basis. a. only asset a is acceptable b. only asset b is acceptable c. neither asset a nor asset b is acceptable d. both asset a and asset b are acceptable

Answers: 2

Business, 22.06.2019 21:00

You have $5,300 to deposit. regency bank offers 6 percent per year compounded monthly (.5 percent per month), while king bank offers 6 percent but will only compounded annually. how much will your investment be worth in 17 years at each bank

Answers: 3

You know the right answer?

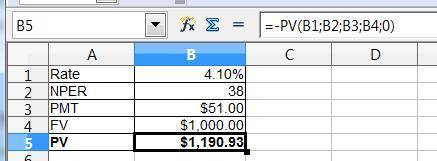

Dexter Mills issued 20-year bonds one year ago at a coupon rate of 10.2 percent. The bonds make semi...

Questions

Mathematics, 19.05.2021 21:30

History, 19.05.2021 21:30

Mathematics, 19.05.2021 21:30

French, 19.05.2021 21:30

Mathematics, 19.05.2021 21:30

Mathematics, 19.05.2021 21:30

Mathematics, 19.05.2021 21:30

Mathematics, 19.05.2021 21:30

Mathematics, 19.05.2021 21:30

Mathematics, 19.05.2021 21:30