Bippus Corporation manufactures two products:

Product X08R and Product P56L.

The compan...

Bippus Corporation manufactures two products:

Product X08R and Product P56L.

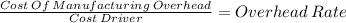

The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products X08R and P56L.

Activity Cost Pool Activity Measure Total Cost Total Activity

Machining Machine-hours $247,000 13,000 MHs

Machine setups Number of setups $60,000 150 setups

Product design Number of products $56,000 2 products

Order size Direct labor-hours $260,000 10,000 DLHs

Activity Measure Product X08R Product P56L

Machine-hours 10,000 3,000

Number of setups 110 40

Number of products 1 1

Direct labor-hours 6,000 4,000

Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product P56L?

Answers: 2

Another question on Business

Business, 21.06.2019 20:20

Jing-sheng facilitated a hiring committee for his advertising company. six employees (including two managers) met together to discuss applicants and select the finalists for a copywriter position in the public relations department. although the head of public relations would have the final nod on the candidate that would ultimately be hired, the evaluative work of the committee was very important because this group would send forward those persons they believed would be good work colleagues. in setting up this type of hiring process, the head of public relations was utilizing a(n) style of leadership.a. autocraticb. free-reinc. contingentd. participative

Answers: 3

Business, 22.06.2019 10:30

Perez, inc., applies the equity method for its 25 percent investment in senior, inc. during 2018, perez sold goods with a 40 percent gross profit to senior, which sold all of these goods in 2018. how should perez report the effect of the intra-entity sale on its 2018 income statement?

Answers: 2

Business, 22.06.2019 11:10

Sam and diane are completing their federal income taxes for the year and have identified the amounts listed here. how much can they rightfully deduct? • agi: $80,000 • medical and dental expenses: $9,000 • state income taxes: $3,500 • mortgage interest: $9,500 • charitable contributions: $1,000.

Answers: 1

Business, 22.06.2019 17:30

Jeanie had always been interested in how individuals and businesses effectively allocate their resources in order to accomplish personal and organizational goals. that’s why she majored in economics and took on an entry-level position at an accounting firm. she is very interested in further advancing her career by looking into a specialization that builds upon her academic background, and her interest in deepening her understanding of how companies adjust their operating results to incorporate the economic impacts of their practices on internal and external stakeholders. which specialization could jeanie follow to get the best of both worlds? jeanie should chose to get the best of both worlds.

Answers: 2

You know the right answer?

Questions

Chemistry, 13.06.2020 00:57

Mathematics, 13.06.2020 00:57

Mathematics, 13.06.2020 00:57

Mathematics, 13.06.2020 00:57

Social Studies, 13.06.2020 00:57

Engineering, 13.06.2020 00:57

Mathematics, 13.06.2020 00:57