Suppose the September Eurodollar futures contract has a price of 96.4. You plan to borrow $50m for 3 months in September at LIBOR, and you intend to use the Eurodollar contract to hedge your borrowing rate.

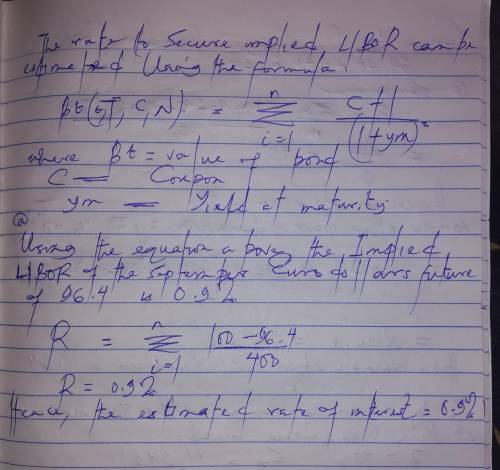

a. What rate can you secure?

b. Will you be long or short the Eurodollar contract?

c. How many contracts will you enter into?

d. Assuming the true 3-month LIBOR is 1% in September, what is the settlement in dollars at expiration of the futures contract? (For purposes of this question, ignore daily marking-to-market on the futures contract.)

Answers: 1

Another question on Business

Business, 22.06.2019 05:40

According to the philosopher immanuel kant, the right of employees to know the nature of the job they are being hired to do and the obligation of a company not to deceive them in this respect is mainly reflective of the basic right of . privac yb. free consentc. freedom of speechd. freedom of consciencee. first refusal

Answers: 1

Business, 22.06.2019 14:50

One pound of material is required for each finished unit. the inventory of materials at the end of each month should equal 20% of the following month's production needs. purchases of raw materials for february would be budgeted to be:

Answers: 2

Business, 22.06.2019 19:00

Gus needs to purée his soup while it's still in the pot. what is the best tool for him to use? a. potato masher b. immersion blender c. rotary mixer d. whisk

Answers: 2

Business, 22.06.2019 20:20

Trade will take place: a. if the maximum that a consumer is willing and able to pay is less than the minimum price the producer is willing and able to accept for a good. b. if the maximum that a consumer is willing and able to pay is greater than the minimum price the producer is willing and able to accept for a good. c. only if the maximum that a consumer is willing and able to pay is equal to the minimum price the producer is willing and able to accept for a good. d. none of the above.

Answers: 3

You know the right answer?

Suppose the September Eurodollar futures contract has a price of 96.4. You plan to borrow $50m for 3...

Questions

Mathematics, 23.07.2020 01:01

Mathematics, 23.07.2020 01:01

Mathematics, 23.07.2020 01:01

Social Studies, 23.07.2020 01:01

English, 23.07.2020 01:01