Business, 06.03.2020 23:49 toricepeda82

Backwoods American, Inc., produces expensive water-repellent, down-lined parkas. Currently, the cost of producing each parka is estimated to be $55. This company is planning to produce approximately 2000 parkas in the next year. The quality manager of the company has estimated that, with the current situation, 15% of the parkas produced will be defective and only 60% of the defective parkas can be reworked. The rework cost is estimated to be $10.

The quality management department has suggested to upgrade the sewing machine to reduce the percentage of defective items. With this upgrade, the cost of producing each parka will be 60$ and the percentage of defective items will be 8%. The rework cost and the percentage of defective items that can be reworked do not change with this upgrade.

Calculate:

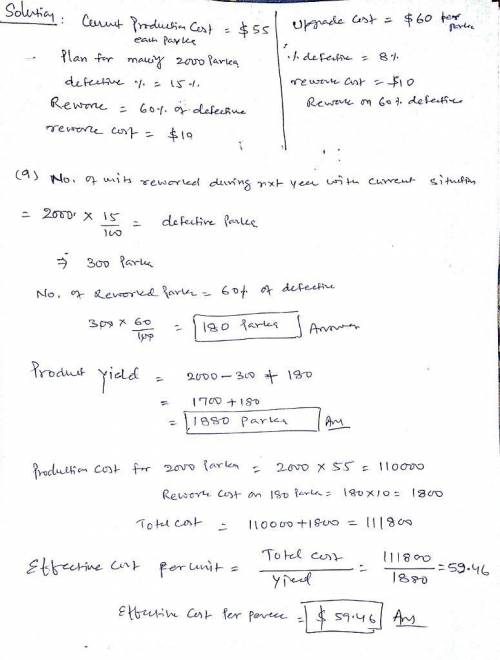

Number of units reworked during the next year, with the current situation:

Product yield during the next year, with the current situation:

Effective per unit production cost, with the current situation:

If the company wants the yield to be 2000, how many parkas they should plan to produce during the next year, with the current situation?

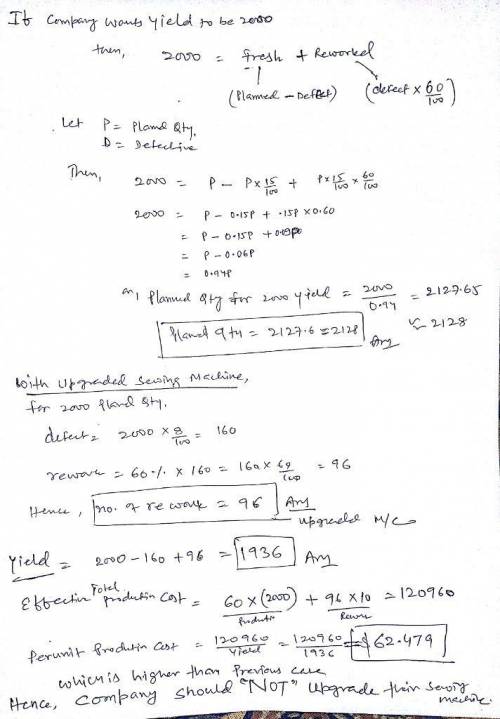

Number of units reworked annually with the upgraded sewing machine:

The Yield during the next year with the upgraded sewing machine:

Effective per unit production cost per with the upgraded sewing machine:

Should the company upgrade their sewing machine?

Yes

No

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

Balance sheet the assets of dallas & associates consist entirely of current assets and net plant and equipment. the firm has total assets of $2 5 million and net plant and equipment equals $2 million. it has notes payable of $150,000, long-term debt of $750,000, and total common equity of $1 5 million. the firm does have accounts payable and accruals on its balance sheet. the firm only finances with debt and common equity, so it has no preferred stock on its balance sheet. a. what is the company's total debt? b. what is the amount of total liabilities and equity that appears on the firm's balance sheet? c. what is the balance of current assets on the firm's balance sheet? d. what is the balance of current liabilities on the firm's balance sheet? e. what is the amount of accounts payable and accruals on its balance sheet? [hint: consider this as a single line item on the firm's balance sheet.] f. what is the firm's net working capital? g. what is the firm's net operating working capital? h. what is the explanation for the difference in your answers to parts f and g?

Answers: 1

Business, 22.06.2019 17:40

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

Business, 22.06.2019 20:30

When patey pontoons issued 4% bonds on january 1, 2018, with a face amount of $660,000, the market yield for bonds of similar risk and maturity was 5%. the bonds mature december 31, 2021 (4 years). interest is paid semiannually on june 30 and december 31?

Answers: 1

Business, 22.06.2019 22:50

Which of these makes a student loan different from other types of loans

Answers: 1

You know the right answer?

Backwoods American, Inc., produces expensive water-repellent, down-lined parkas. Currently, the cost...

Questions

Biology, 27.11.2021 15:10

English, 27.11.2021 15:20

Mathematics, 27.11.2021 15:20

World Languages, 27.11.2021 15:20

Geography, 27.11.2021 15:20

Mathematics, 27.11.2021 15:20

Mathematics, 27.11.2021 15:20

Computers and Technology, 27.11.2021 15:20

Computers and Technology, 27.11.2021 15:20

English, 27.11.2021 15:30

World Languages, 27.11.2021 15:30

Chemistry, 27.11.2021 15:30

Chemistry, 27.11.2021 15:30