Business, 07.03.2020 01:44 ethangeibel007

Suppose Ryan acquired land sometime in the past at a cost of $2,000,000. During the current year, it sells the land to Patrick (subsidiary) for $2,500,000. Prior to consolidation, a gain of $500,000 (= $2,500,000 - $2,000,000) appears on Ryan's books, and Patrick's books carry the land at $2,500,000. At the date of consolidation, Patrick still owns the land. The necessary eliminating entry made in consolidation for the year of sale is:

Select one:

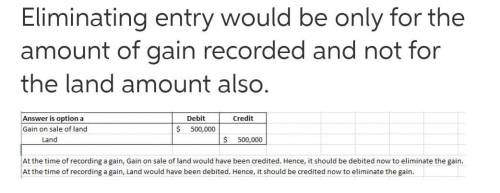

a. Gain on sale of land 500,000

Land 500,000

b. Gain on sale of land 2,000,000

Land 2,000,000

c. Gain on sale of land 2,500,000

Land 2,500,000

d. No elimination entry is necessary

Answers: 2

Another question on Business

Business, 21.06.2019 23:00

Which of the following statements is correct? a. two firms with identical sales and operating costs but with different amounts of debt and tax rates will have different operating incomes by definition. b. free cash flow (fcf) is, essentially, the cash flow that is available for interest and dividends after the company has made the investments in current and fixed assets that are necessary to sustain ongoing operations. c. retained earnings as reported on the balance sheet represent cash and, therefore, are available to distribute to stockholders as dividends or any other required cash payments to creditors and suppliers. d. if a firm is reporting its income in accordance with generally accepted accounting principles, then its net income as reported on the income statement should be equal to its free cash flow. e. after-tax operating income is calculated as ebit(1 - t) + depreciation.

Answers: 2

Business, 22.06.2019 10:10

True tomato inc. makes organic ketchup. to promote its products, this firm decided to make bottles in the shape of tomatoes. to accomplish this, true tomato worked with its bottle manufacture to create a set of unique molds for its bottles. which of the following specialized assets does this example demonstrate? (a) site specificity (b) research specificity (c) physical-asset specificity (d) human-asset specificity

Answers: 3

Business, 23.06.2019 01:30

Bruce matthews played football for the tennessee titans. as part of his contract, he agreed to submit any dispute to arbitra- tion. he also agreed that tennessee law would determine all matters related to workers' compensation. after matthews retired, he filed a workers' compensation claim in california. the arbitrator ruled that matthews could pursue his claim in california but only under tennessee law. should this award be set aside?

Answers: 2

Business, 23.06.2019 02:20

You park your car on sixth street and walk over to the quad for lunch. while crossing wright street, you are hit by a bicyclist and knocked to the ground. you hit your head so hard you are knocked out. when you wake up, the person who hit you is gone. you incur $45,000 in medical bills. the person who hit you would be liable for $150,000 in damages if you could find them. your policy will pay:

Answers: 1

You know the right answer?

Suppose Ryan acquired land sometime in the past at a cost of $2,000,000. During the current year, it...

Questions

Physics, 20.05.2021 22:10

Biology, 20.05.2021 22:10

Mathematics, 20.05.2021 22:10

English, 20.05.2021 22:10

Social Studies, 20.05.2021 22:10

Computers and Technology, 20.05.2021 22:10