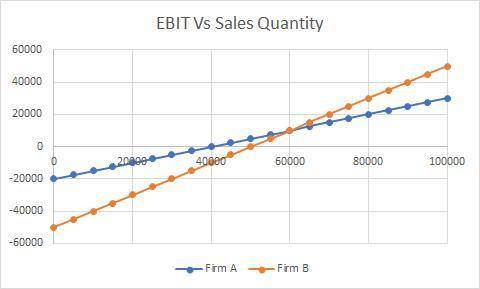

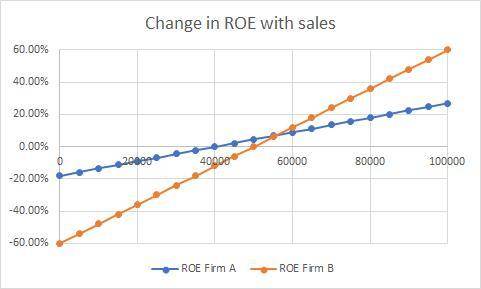

Consider two firms. Firm A has a DOL of 3.0, an expected ROE of 9% with a standard deviation of 6%, and an EBIT of $10,000 when sales are 60,000 units. Firm B has a DOL of 6.0, an expected ROE of 12% with a standard deviation of 15%, and an EBIT of $10,000 when sales are 60,000 units. On the same graph, depict EBIT as a function of sales for the two firms. On a separate graph, depict the distribution of ROE for the two firms. Calculate the coefficient of variation for both firms.

Answers: 3

Another question on Business

Business, 22.06.2019 13:20

Last year, johnson mills had annual revenue of $37,800, cost of goods sold of $23,200, and administrative expenses of $6,300. the firm paid $700 in dividends and had a tax rate of 35 percent. the firm added $2,810 to retained earnings. the firm had no long-term debt. what was the depreciation expense?

Answers: 2

Business, 22.06.2019 18:20

Now ray has had the tires for two months and he notices that the tread has started to pull away from the tire. he has already contacted the place who sold the tires and calmly and accurately explained the problem. they didn’t him because they no longer carry that tire. so he talked with the manager and he still did not get the tire replaced. his consumer rights are being violated. pretend you are ray and write a letter to the company’s headquarters. here are some points to keep in mind when writing the letter: include your name, address, and account number, if appropriate. describe your purchase (name of product, serial numbers, date and location of purchase). state the problem and give the history of how you tried to resolve the problem. ask for a specific action. include how you can be reached.

Answers: 3

Business, 22.06.2019 19:10

After the price floor is instituted, the chairman of productions office buys up any barrels of gosum berries that the producers are not able to sell. with the price floor, the producers sell 300 barrels per month to consumers, but the producers, at this high price floor, produce 700 barrels per month. how much producer surplus is created with the price floor? show your calculations.

Answers: 2

Business, 22.06.2019 20:20

As you have noticed, the demand for flip phones has drastically reduced, and there are only a few consumer electronics companies selling them at extremely low prices. also, the current buyers of flip phones are mainly categorized under laggards. which of the following stages of the industry life cycle is the flip phone industry in currently? a. growth stage b. maturity stage c. decline stage d. commercialization stage

Answers: 2

You know the right answer?

Consider two firms. Firm A has a DOL of 3.0, an expected ROE of 9% with a standard deviation of 6%,...

Questions

Arts, 01.04.2022 16:50

English, 01.04.2022 17:00

Mathematics, 01.04.2022 17:20

English, 01.04.2022 17:30

Engineering, 01.04.2022 17:40

Mathematics, 01.04.2022 17:40

History, 01.04.2022 17:50