Business, 07.03.2020 05:59 loveagirl111puppy

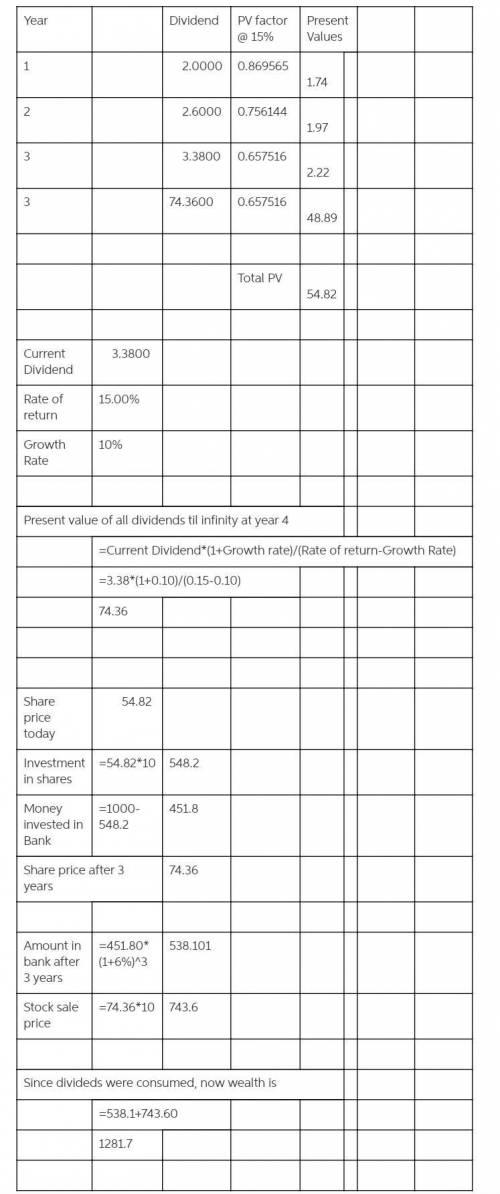

The Goliath Inc. decides to pay the following dividends over the next three years: $2, $2.6, and $3.38. Thereafter, the company will maintain a constant 10% growth rate in dividends forever. The required return of Goliath’s stock is 15%. Suppose Victor has $1000 today. He decides to buy 10 shares of Goliath’s stock today and save the rest of his $1000 into the Whales Cargo bank, which provides an annual interest rate of 6%. Victor will sell his shares of Goliath’s stock in year 3 and withdraw the money from the bank as well. Victor wants to know how much money he can have in year 3, with such an investment plan.

What is the stock price of Goliath Inc. today?

How much money can Victor save in the bank today?

What is the stock price (per share) of Goliath Inc. when Victor sells it in year 3 (immediately after the third dividend is paid out)?

How much money can Victor withdraw from the bank in year 3?

With such an investment plan, how much money will Victor have in year 3? Suppose Victor consumes all his dividends over these years and his wealth consists of the capital gains from the stock and the money withdrawal from the bank.

Answers: 2

Another question on Business

Business, 21.06.2019 14:20

What is the proper adjusted cash balance per bank? (round answers to 2 decimal places, e.g. 52.75.) the proper adjusted cash balance per bank $enter a dollar amount rounded to 2 decimal places (b) what is the proper adjusted cash balance per books? (round answers to 2 decimal places, e.g. 52.75.) the proper adjusted cash balance per books

Answers: 3

Business, 21.06.2019 20:00

Jorge is a manager at starbucks. his operational plan includes achieving annual sales of $4,000,000 for his store. with only one month left to end of the fiscal year, jorge realizes that he won't reach his annual sales goal. what are his options?

Answers: 2

Business, 22.06.2019 12:50

You are working on a bid to build two city parks a year for the next three years. this project requires the purchase of $249,000 of equipment that will be depreciated using straight-line depreciation to a zero book value over the three-year project life. ignore bonus depreciation. the equipment can be sold at the end of the project for $115,000. you will also need $18.000 in net working capital for the duration of the project. the fixed costs will be $37000 a year and the variable costs will be $148,000 per park. your required rate of return is 14 percent and your tax rate is 21 percent. what is the minimal amount you should bid per park? (round your answer to the nearest $100) (a) $214,300 (b) $214,100 (c) $212,500 (d) $208,200 (e) $208,400

Answers: 3

Business, 22.06.2019 20:00

Qwest airlines has implemented a program to recycle all plastic drink cups used on their aircraft. their goal is to generate $7 million by the end of the recycle program's five-year life. each recycled cup can be sold for $0.005 (1/2 cent). a. how many cups must be recycled annually to meet this goal? assume uniform annual plastic cup usage and a 0% interest rate. b. repeat part (a) when the annual interest rate is 12%. c. why is the answer to part (b) less than the answer to part (a)?

Answers: 1

You know the right answer?

The Goliath Inc. decides to pay the following dividends over the next three years: $2, $2.6, and $3....

Questions

SAT, 22.10.2020 23:01

History, 22.10.2020 23:01

Mathematics, 22.10.2020 23:01

Chemistry, 22.10.2020 23:01

English, 22.10.2020 23:01

Mathematics, 22.10.2020 23:01

Mathematics, 22.10.2020 23:01

Mathematics, 22.10.2020 23:01

Mathematics, 22.10.2020 23:01

![\left[\begin{array}{ccc}Years&Cashflow&Discounted\\&&\\1&2&1.74\\2&2.6&1.97\\3&3.38&2.22\\3&74.36&48.89\\&total&54.82\\\end{array}\right]](/tpl/images/0538/0564/b686a.png)