Business, 10.03.2020 00:15 LilBrookilyn2701

Westwood Furniture Company is considering the purchase of two different items of equipment, as described below:

Machine A:

A compacting machine has just come onto the market that would permit Westwood Furniture Company to compress sawdust into various shelving products. At present, the sawdust is disposed of as a waste product. The following information is available on the machine:

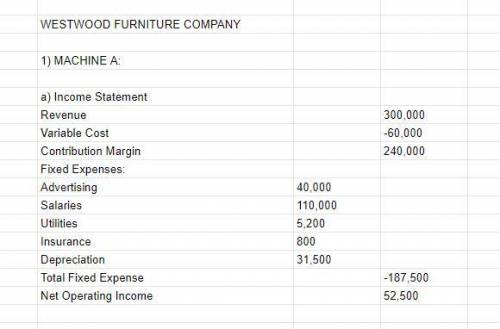

a. The machine would cost $420,000 and would have a 10% salvage value at the end of its 12-year useful life. The company uses straight-line depreciation and considers salvage value in computing depreciation deductions.

b. The shelving products manufactured from use of the machine would generate revenues of $300,000 per year. Variable manufacturing costs would be 20% of sales.

c. Fixed expenses associated with the new shelving products would be (per year): advertising, $40,000: salaries, $110,000; utilities, $5,200; and insurance, $800.

Machine B:

A second machine has come onto the market that would allow Westwood Furniture Company to automate a sanding process that is now done largely by hand. The following information is available:

a. The new sanding machine would cost $234,000 and would have no salvage value at the end of its 13-year useful life. The company would use straight-line depreciation on the new machine.

b. Several old pieces of sanding equipment that are fully depreciated would be disposed of at a scrap value of $9,000.

c. The new sanding machine would provide substantial annual savings in cash operating costs. It would require an operator at an annual salary of $16,350 and $5,400 in annual maintenance costs. The current hand-operated sanding

procedure costs the company $78,000 per year in total.

Westwood Furniture Company requires a simple rate of return of 15% on all equipment purchases. Also, the company will not purchase equipment unless the equipment has a payback period of 4.0 years or less.

Required:

1. For machine A:

a. Prepare an income statement showing the expected net operating income each year from the new shelving products. Use the contribution format.

b. Compute the simple rate of return.

c. Compute the payback period.

2. For machine B:

a. Compute the simple rate of return.

b. Compute the payback period.

3. According to the company’s criteria, which machine, if either, should the company purchase?

Answers: 1

Another question on Business

Business, 22.06.2019 05:00

Personal financial planning is the process of creating and achieving financial goals? true or false

Answers: 1

Business, 22.06.2019 17:20

Andy owns islander surfboard inc. in the past, andy has always given his employees bonuses during the holidays if they reached certain sales goals. this year, even though the company is thriving, he decided to cut bonuses from employees and award them to himself instead. what ethical theory of leadership is andy following?

Answers: 1

Business, 22.06.2019 19:00

Adrawback of short-term contracting as an alternative to making a component in-house is thata. it is the most-integrated alternative to performing an activity so the principal company has no control over the agent. b. the supplying firm has no incentive to make any transaction-specific investments to increase performance or quality. c. it fails to allow a long planning period that individual market transactions provide. d. the buying firm cannot demand lower prices due to the lack of a competitive bidding process.

Answers: 2

Business, 22.06.2019 20:00

Describe a real or made-up but possible example of a situation where an employee faces a conflict of interest. explain at least two things the company could do to make sure the employee won't be tempted into unethical behavior by that conflict of interest. (3.0 points)

Answers: 3

You know the right answer?

Westwood Furniture Company is considering the purchase of two different items of equipment, as descr...

Questions

English, 21.05.2021 01:00

Mathematics, 21.05.2021 01:00

English, 21.05.2021 01:00

History, 21.05.2021 01:00

Mathematics, 21.05.2021 01:00

Mathematics, 21.05.2021 01:00

Mathematics, 21.05.2021 01:00

Mathematics, 21.05.2021 01:00

English, 21.05.2021 01:00

Mathematics, 21.05.2021 01:00

Mathematics, 21.05.2021 01:00