Business, 10.03.2020 07:46 nyasiasaunders1234

Calvin reviewed his canceled checks and receipts this year for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005.

Donee Item Cost FMV

Hobbs Medical-

Center IBM stock $5,000 $22,000

State Museum Painting 5,000 3,000

A needy family Food and clothes 400 250

United Way Cash 8,000 8,000

Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances:

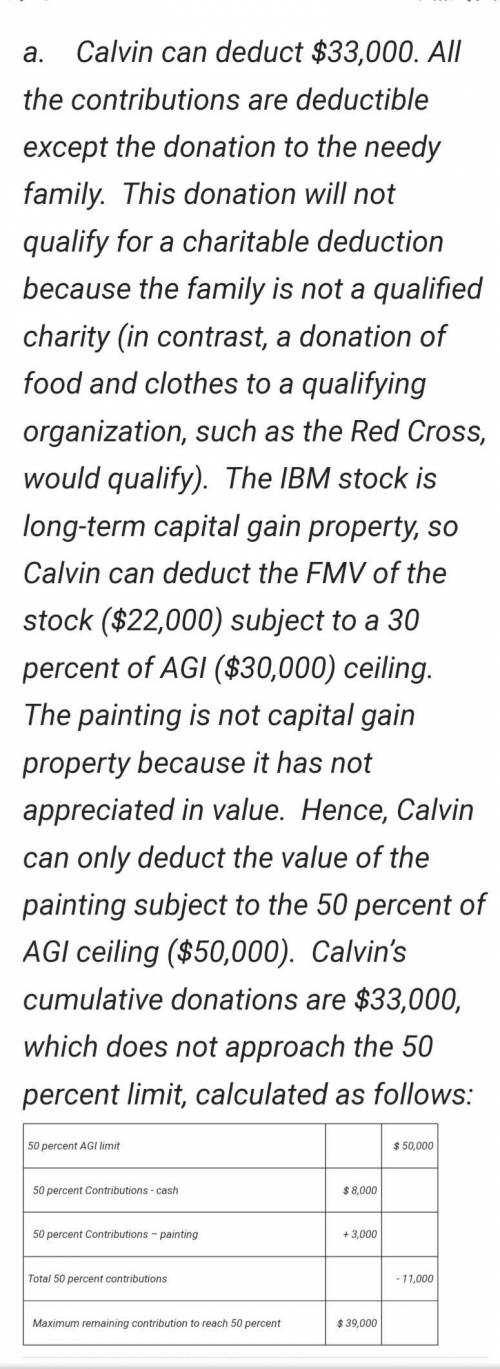

(A) Calvin’s AGI is $100,000

(B) Calvin’s AGI is $100,000 but the State Museum told Calvin that it plans to sell the painting

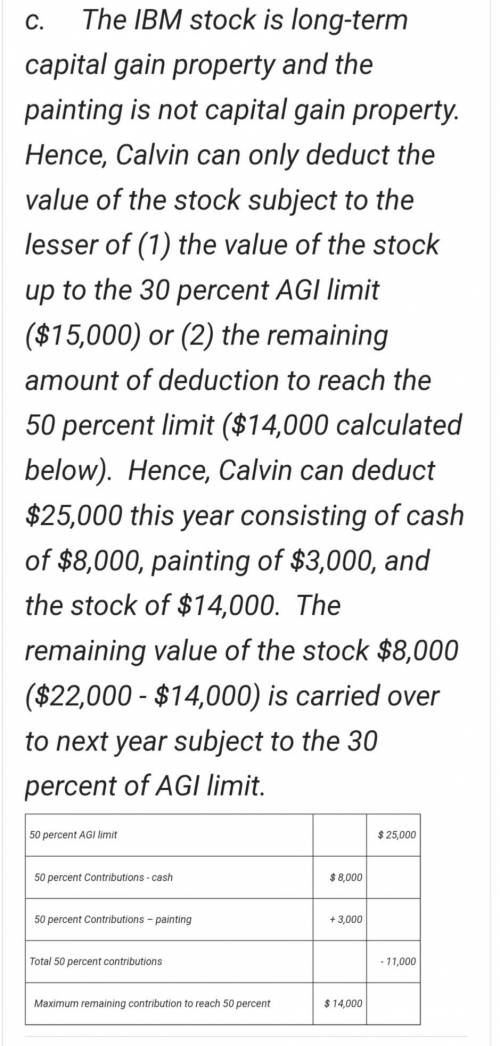

(C) Calvin’s AGI is $50,000.

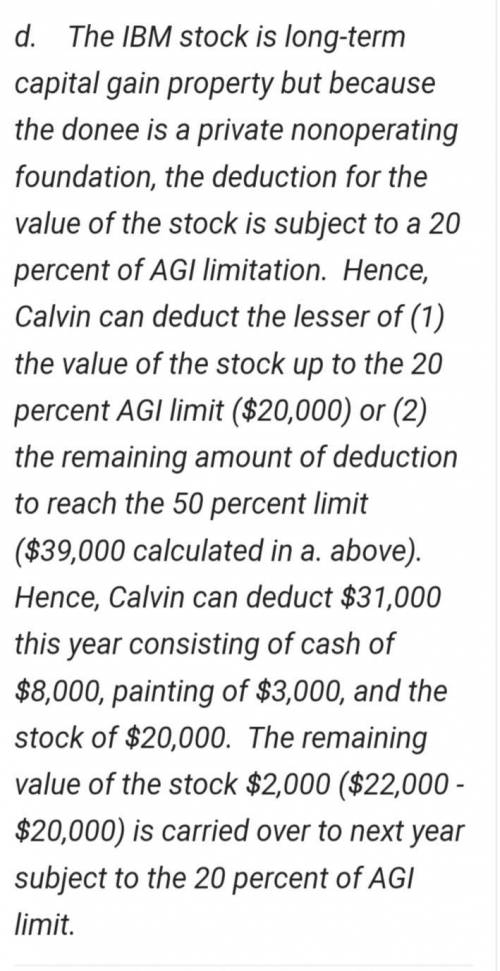

(D) Calvin’s AGI is $100,000 and Hobbs is a nonoperating private foundation.

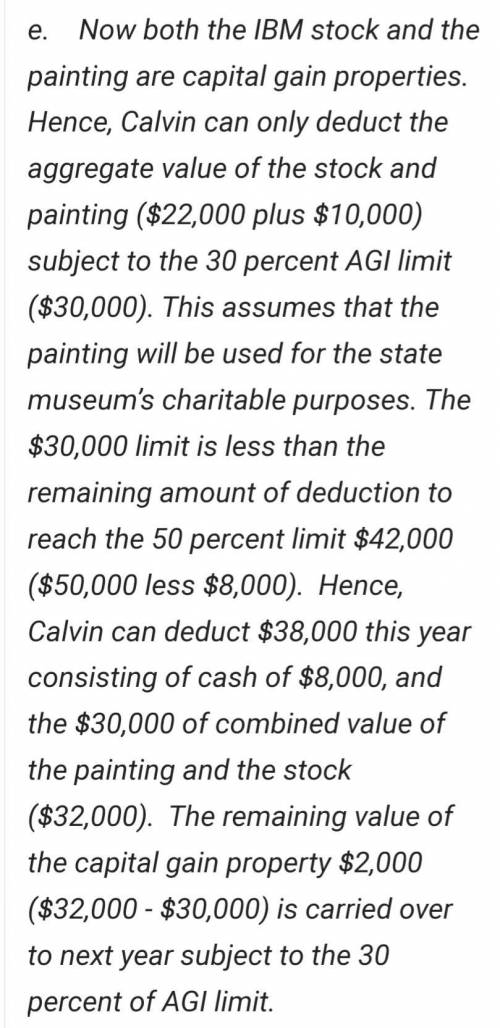

(E) Calvin’s AGI is $100,000 but the painting is worth $10,000.

Answers: 1

Another question on Business

Business, 21.06.2019 22:00

Sharon had some insider information about a corporate takeover. she unintentionally informed a friend, who immediately bought the stock in the target corporation. the takeover occurred and the friend made a substantial profit from buying and selling the stock. the friend told sharon about his stock dealings, and gave her a pearl necklace because she "made it all possible." the necklace was worth $10,000, but she already owned more jewelry than she desired.

Answers: 2

Business, 22.06.2019 05:30

Find a company that has followed a strong strategic direction- state that generic strategy and the back-up points to support your position.

Answers: 1

Business, 22.06.2019 20:00

Double corporation acquired all of the common stock of simple company for

Answers: 1

Business, 22.06.2019 20:40

Aggart technologies is considering issuing new common stock and using the proceeds to reduce its outstanding debt. the stock issue would have no effect on total assets, the interest rate taggart pays, ebit, or the tax rate. which of the following is likely to occur if the company goes ahead with the stock issue? a. the roa will decline.b. taxable income will decline.c. the tax bill will increase.d. net income will decrease.e. the times-interest-earned ratio will decrease

Answers: 1

You know the right answer?

Calvin reviewed his canceled checks and receipts this year for charitable contributions, which inclu...

Questions

Mathematics, 11.03.2021 09:30

Mathematics, 11.03.2021 09:30

History, 11.03.2021 09:30

Biology, 11.03.2021 09:30

Mathematics, 11.03.2021 09:30

Mathematics, 11.03.2021 09:40

English, 11.03.2021 09:40

Engineering, 11.03.2021 09:40

Mathematics, 11.03.2021 09:40

Mathematics, 11.03.2021 09:40