Business, 10.03.2020 19:34 anglekhan101

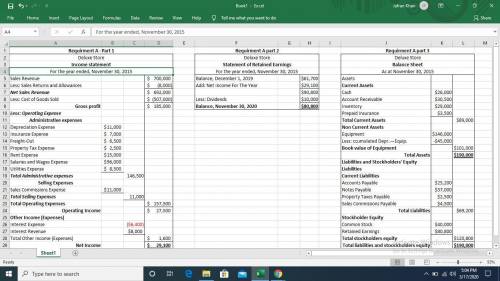

The Deluxe Store is located in midtown Madison. During the past several years, net income has been declining because of suburban shopping centers. At the end of the company's fiscal year on November 30, 2015, the following accounts appeared in two of its trial balances.

Unadjusted Adjusted

Accounts Payable $25,200 $25,200

Accounts Receivable 30,500 30,500

Accumulated Depr.—Equip. 34,000 45,000

Cash 26,000 26,000

Common Stock 40,000 40,000

Cost of Goods Sold 507,000 507,000

Dividends 10,000 10,000

Freight-Out 6,500 6,500

Equipment 146,000 146,000

Depreciation Expense 11,000

Insurance Expense 7,000

Interest Expense 6,400 6,400

Interest Revenue 8,000 8,000

Inventory $29,000 $29,000

Notes Payable 37,000 37,000

Prepaid Insurance 10,500 3,500

Property Tax Expense 2,500

Property Taxes Payable 2,500

Rent Expense 15,000 15,000

Retained Earnings 61,700 61,700

Salaries and Wages Expense 96,000 96,000

Sales Commissions Expense 6,500 11,000

Sales Commissions Payable 4,500

Sales Returns and Allowances 8,000 8,000

Sales Revenue 700,000 700,000

Utilities Expense 8,500 8,500

A. Prepare a multiple-step income statement, a retained earnings statement, and a classified balance sheet. Notes payable are due in 2018. (Check Figures: Net Income $29,100 Retained Earnings $80,800 Total Assets $190,000)

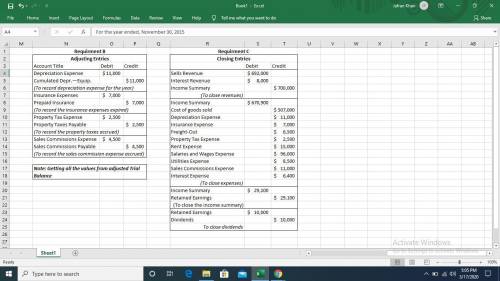

B. Journalize the adjusting entries that were made.

C. Journalize the closing entries that are necessary.

Answers: 3

Another question on Business

Business, 22.06.2019 03:30

Assume that all of thurmond company’s sales are credit sales. it has been the practice of thurmond company to provide for uncollectible accounts expense at the rate of one-half of one percent of net credit sales. for the year 20x1 the company had net credit sales of $2,021,000 and the allowance for doubtful accounts account had a credit balance, before adjustments, of $630 as of december 31, 20x1. during 20x2, the following selected transactions occurred: jan. 20 the account of h. scott, a deceased customer who owed $325, was determined to be uncollectible and was therefore written off. mar. 16 informed that a. nettles, a customer, had been declared bankrupt. his account for $898 was written off. apr. 23 the $906 account of j. kenney & sons was written off as uncollectible. aug. 3 wrote off as uncollectible the $750 account of clarke company. oct. 20 wrote off as uncollectible the $1,130 account of g. michael associates. oct. 27 received a check for $325 from the estate of h. scott. this amount had been written off on january 20 of the current year. dec. 20 cater company paid $7,000 of the $7,500 it owed thurmond company. since cater company was going out of business, the $500 balance it still owed was deemed uncollectible and written off. required: prepare journal entries for the december 31, 20x1, and the seven 20x2 transactions on the work sheets provided at the back of this unit. then answer questions 8 and 9 on the answer sheet. t-accounts are also provided for your use in answering these questions. 8. which one of the following entries should have been made on december 31, 20x1?

Answers: 1

Business, 22.06.2019 12:30

howard, fine, & howard is an advertising agency. the firm uses an activity-based costing system to allocate overhead costs to its services. information about the firm's activity cost pool rates follows: stooge company was a client of howard, fine, & howard. recently, 7 administrative assistant hours, 3 new ad campaigns, and 8 meeting hours were incurred for the stooge company account. using the activity-based costing system, how much overhead cost would be allocated to the stooge company account?

Answers: 1

Business, 22.06.2019 20:20

Trade will take place: a. if the maximum that a consumer is willing and able to pay is less than the minimum price the producer is willing and able to accept for a good. b. if the maximum that a consumer is willing and able to pay is greater than the minimum price the producer is willing and able to accept for a good. c. only if the maximum that a consumer is willing and able to pay is equal to the minimum price the producer is willing and able to accept for a good. d. none of the above.

Answers: 3

Business, 22.06.2019 20:30

John and daphne are saving for their daughter ellen's college education. ellen just turned 10 at (t = 0), and she will be entering college 8 years from now (at t = 8). college tuition and expenses at state u. are currently $14,500 a year, but they are expected to increase at a rate of 3.5% a year. ellen should graduate in 4 years--if she takes longer or wants to go to graduate school, she will be on her own. tuition and other costs will be due at the beginning of each school year (at t = 8, 9, 10, and 11).so far, john and daphne have accumulated $15,000 in their college savings account (at t = 0). their long-run financial plan is to add an additional $5,000 in each of the next 4 years (at t = 1, 2, 3, and 4). then they plan to make 3 equal annual contributions in each of the following years, t = 5, 6, and 7. they expect their investment account to earn 9%. how large must the annual payments at t = 5, 6, and 7 be to cover ellen's anticipated college costs? a. $1,965.21b. $2,068.64c. $2,177.51d. $2,292.12e. $2,412.76

Answers: 1

You know the right answer?

The Deluxe Store is located in midtown Madison. During the past several years, net income has been d...

Questions

English, 17.10.2019 20:30

Mathematics, 17.10.2019 20:30

Mathematics, 17.10.2019 20:30

English, 17.10.2019 20:30

Chemistry, 17.10.2019 20:30

Mathematics, 17.10.2019 20:30

Chemistry, 17.10.2019 20:30