On March 1, 2016, Gold Examiner receives $159,000 from a local bank and promises to deliver 95 units of certified 1-oz. gold bars on a future date. The contract states that ownership passes to the bank when Gold Examiner delivers the products to Brink�s, a third-party carrier. In addition, Gold Examiner has agreed to provide a replacement shipment at no additional cost if the product is lost in transit. The stand-alone price of a gold bar is $1,710 per unit, and Gold Examiner estimates the stand-alone price of the replacement insurance service to be $90 per unit. Brink�s picked up the gold bars from Gold Examiner on March 30, and delivery to the bank occurred on April 1.

Required:

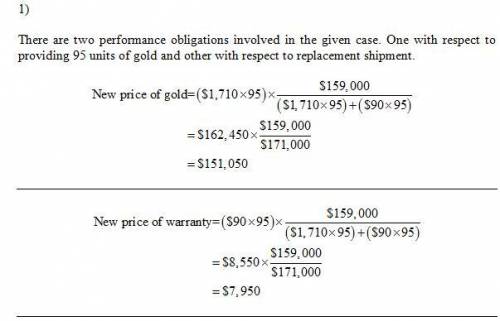

1. How many performance obligations are in this contract?

2. to 4.

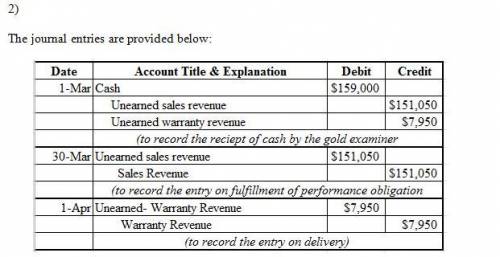

Prepare the journal entry Gold Examiner would record on March 1, March 30 and April 1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Answers: 1

Another question on Business

Business, 21.06.2019 21:20

According to the u.s. census bureau (), the median household income in the united states was $23,618 in 1985, $34,076 in 1995, $46,326 in 2005, and $57,230 in 2015. in purchasing power terms, how did family income compare in each of those four years? you will need to know that the cpi (multiplied by 100, 1982–1984 = 100) was 107.6 in 1985, 152.4 in 1995, 195.3 in 2005, and 237.0 in 2015

Answers: 3

Business, 22.06.2019 07:30

Jewelry manufacturers produce a range of products such as rings, necklaces, bracelets, and brooches. what fundamental economic question are they addressing by offering this range of items?

Answers: 3

Business, 22.06.2019 11:00

Why are the four primary service outputs of spatial convenience, lot size, waiting time, and product variety important to logistics management? provide examples of competing firms that differ in the level of each service output provided to customers?

Answers: 1

Business, 22.06.2019 19:20

Why is following an unrelated diversification strategy especially advantageous in an emerging economy? a. it allows the conglomerate to overcome institutional weaknesses in emerging economies. b. it allows the conglomerate to form a monopoly in emerging economies. c. it allows the conglomerate to use well-defined legal systems in emerging economies. d. it allows the conglomerate to take advantage of strong capital markets in emerging economies.

Answers: 1

You know the right answer?

On March 1, 2016, Gold Examiner receives $159,000 from a local bank and promises to deliver 95 units...

Questions

English, 28.06.2021 16:50

Engineering, 28.06.2021 17:00

Social Studies, 28.06.2021 17:00

History, 28.06.2021 17:00

Computers and Technology, 28.06.2021 17:00

History, 28.06.2021 17:00

Biology, 28.06.2021 17:00