Business, 11.03.2020 03:02 ariannapenny98

Whitney received $75,000 of taxable income in 2017. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations? Use Tax Rate Schedule for reference. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

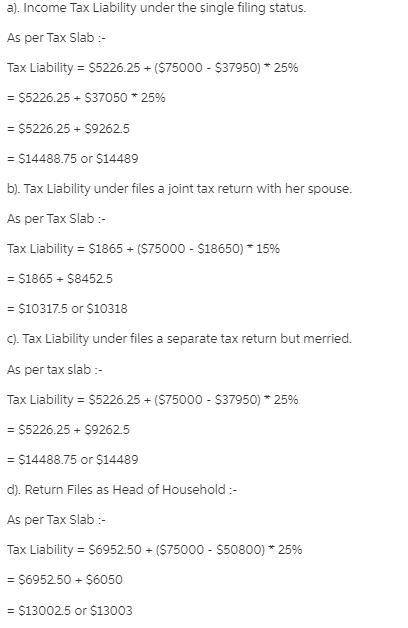

a. She files under the single filing status.

b. She files a joint tax return with her spouse. Together their taxable income is $75,000.

c. She is married but files a separate tax return. Her taxable income is $75,000.

d. She files as a head of household.

Answers: 3

Another question on Business

Business, 22.06.2019 12:50

Salaries are $4,500 per week for five working days and are paid weekly at the end of the day fridays. the end of the month falls on a thursday. the accountant for dayton company made the appropriate accrual adjustment and posted it to the ledger. the balance of salaries payable, as shown on the adjusted trial balance, will be a (assume that there was no beginning balance in the salaries payable account.)

Answers: 1

Business, 22.06.2019 17:00

Serious question, which is preferred in a business? pp or poopoo?

Answers: 1

Business, 22.06.2019 21:20

Which of the following best explains how trade enables greater specialization among producers? a. trade diversifies the market by bringing specialized goods from around the world. b. trade requires distribution networks and adds one more step to the production process. c. trade enables producers to open up new markets for their goods and services. d. trade allows people to focus on one kind of production and trade for their other needs.

Answers: 1

Business, 22.06.2019 23:00

How is challah bread made? if i have to dabble the recipe?

Answers: 1

You know the right answer?

Whitney received $75,000 of taxable income in 2017. All of the income was salary from her employer....

Questions

English, 28.11.2020 07:50

Mathematics, 28.11.2020 07:50

English, 28.11.2020 07:50

History, 28.11.2020 07:50

Business, 28.11.2020 07:50

Health, 28.11.2020 07:50

Mathematics, 28.11.2020 07:50

Mathematics, 28.11.2020 07:50

Mathematics, 28.11.2020 07:50

Chemistry, 28.11.2020 07:50

Mathematics, 28.11.2020 07:50

Computers and Technology, 28.11.2020 07:50

Law, 28.11.2020 07:50

Chemistry, 28.11.2020 07:50