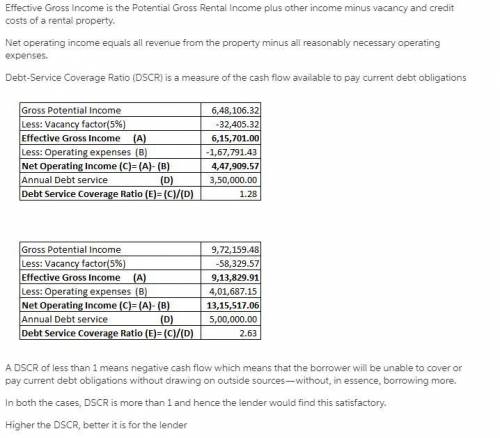

An apartment complex has a gross rental income of $648,106.32 and total operating expenses of $167,791.43. The vacancy factor is 5%, and the annual debt service (P&I for the loan) is $350,000 Calculate: Effective Gross Income, Net Operating Income and the Debt Service Coverage Ratio (DSCR). Use the format we used in class and show all your work. Based on what we discussed in class, would a lender find this DSCR satisfactory? Why or why not?

Answers: 3

Another question on Business

Business, 22.06.2019 12:00

Agovernment receives a gift of cash and investments with a fair value of $200,000. the donor specified that the earnings from the gift must be used to beautify city-owned parks and the principal must be re-invested. the $200,000 gift should be accounted for in which of the following funds? a) general fund b) private-purpose trust fund c) agency fund d) permanent fund

Answers: 1

Business, 22.06.2019 12:50

Kendrick is leaving his current position at a company, and charlize is taking over. kendrick set up his powerpoint for easy access for himself. charlize needs to work in the program that is easy for her to use. charlize should reset advanced options

Answers: 3

Business, 22.06.2019 16:30

On april 1, the cash account balance was $46,220. during april, cash receipts totaled $248,600 and the april 30 balance was $56,770. determine the cash payments made during april.

Answers: 1

Business, 22.06.2019 19:20

Royal motor corp. generates a major portion of its revenues by manufacturing luxury sports cars. however, the company also derives an insignificant percent of its annual revenues by selling its sports merchandise that includes apparel, shoes, and other accessories under the same brand name. which of the following terms best describes royal motor corp.? a. aconglomerate b. a subsidiary c. adominant-businessfirm d. a single-business firm

Answers: 1

You know the right answer?

An apartment complex has a gross rental income of $648,106.32 and total operating expenses of $167,7...

Questions

Mathematics, 19.02.2020 20:04

Mathematics, 19.02.2020 20:04

Mathematics, 19.02.2020 20:04

Mathematics, 19.02.2020 20:04

History, 19.02.2020 20:05

Biology, 19.02.2020 20:05

Biology, 19.02.2020 20:05