Business, 12.03.2020 05:14 george27212

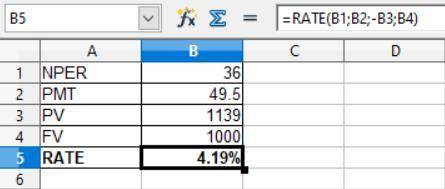

BDJ Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company currently has 9.9 percent coupon bonds on the market that sell for $1,139, make semiannual payments, have a par value of $1,000, and mature in 18 years.

Required:

What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not include the percent sign (%). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e. g., 32.16).)

Answers: 3

Another question on Business

Business, 22.06.2019 09:00

Brian has been working for a few years now and has saved a substantial amount of money. he now wants to invest 50 percent of his savings in a bank account where it will be locked for three years and gain interest. which type of bank account should brian open? a. savings account b. money market account c. checking account d. certificate of deposit

Answers: 1

Business, 22.06.2019 19:00

The market demand curve for a popular teen magazine is given by q = 80 - 10p where p is the magazine price in dollars per issue and q is the weekly magazine circulation in units of 10,000. if the circulation is 400,000 per week at the current price, what is the consumer surplus for a teen reader with maximum willingness to pay of $3 per issue?

Answers: 1

Business, 23.06.2019 06:30

Will mark the ! hurry ! drag and drop the ethnic group to identify the country where it is the majority. ethnic groups may be used more than once. match to the right boxcristian greeks. arabs. persiansiran qatar cyprus iraq

Answers: 1

Business, 23.06.2019 09:50

Now, use your previously-computed value as an approximation for sigma, and compute how many ears of the experimental corn the researcher needs in the study. don't forget, the margin of error and confidence level have already been given to you in a previous problem.

Answers: 1

You know the right answer?

BDJ Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company curren...

Questions

Mathematics, 16.12.2020 18:30

Engineering, 16.12.2020 18:30

Biology, 16.12.2020 18:30

Mathematics, 16.12.2020 18:30

English, 16.12.2020 18:30

Mathematics, 16.12.2020 18:30

English, 16.12.2020 18:30