Answers: 2

Another question on Business

Business, 21.06.2019 22:30

Abusiness cycle reflects in economic activity, particularly real gdp. the stages of a business cycle

Answers: 2

Business, 22.06.2019 05:10

The total value of your portfolio is $10,000: $3,000 of it is invested in stock a and the remainder invested in stock b. stock a has a beta of 0.8; stock b has a beta of 1.2. the risk premium on the market portfolio is 8%; the risk-free rate is 2%. additional information on stocks a and b is provided below. return in each state state probability of state stock a stock b excellent 15% 15% 5% normal 50% 9% 7% poor 35% -15% 10% what are each stock’s expected return and the standard deviation? what are the expected return and the standard deviation of your portfolio? what is the beta of your portfolio? using capm, what is the expected return on the portfolio? given your answer above, would you buy, sell, or hold the portfolio?

Answers: 1

Business, 22.06.2019 15:20

Abank has $132,000 in excess reserves and the required reserve ratio is 11 percent. this means the bank could have in checkable deposit liabilities and in (total) reserves.

Answers: 3

You know the right answer?

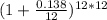

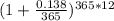

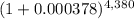

Account A pays 13.8% interest per year. Account B pays 13.5% interest per year, compounded monthly....

Questions

Arts, 31.08.2019 07:50

Biology, 31.08.2019 07:50

Mathematics, 31.08.2019 07:50

History, 31.08.2019 07:50

Health, 31.08.2019 07:50

English, 31.08.2019 07:50

Chemistry, 31.08.2019 07:50

English, 31.08.2019 07:50