A widget manufacturer has an infinitely substitutable production function of the form:

...

Business, 13.03.2020 04:41 pelaezaiden35

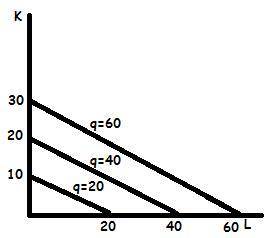

A widget manufacturer has an infinitely substitutable production function of the form:

q = 2K + L

If the wage rate (w) is $1 and the rental rate on capital (v) is $1, what cost-minimizing combination of K and L will the manufacturer employ for the three different production levels in part a? What is the manufacturer’s expansion path?

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

Upscale hotels in the united states recently cut their prices by 20 percent in an effort to bolster dwindling occupancy rates among business travelers. a survey performed by a major research organization indicated that businesses are wary of current economic conditions and are now resorting to electronic media, such as the internet and the telephone, to transact business. assume a company's budget permits it to spend $5,000 per month on either business travel or electronic media to transact business. graphically illustrate how a 20 percent decline in the price of business travel would impact this company's budget set if the price of business travel was initially $1,000 per trip and the price of electronic media was $500 per hour. suppose that, after the price of business travel drops, the company issues a report indicating that its marginal rate of substitution between electronic media and business travel is 1. is the company allocating resources efficiently? explain.

Answers: 1

Business, 22.06.2019 06:00

Why might a business based on a fad be a good idea? question 2 options: fads bring in the most customers. some fads are longer lasting than expected. fads have made some business owners incredibly wealthy. fads can take a business in a new direction.

Answers: 2

Business, 22.06.2019 06:30

Select all that apply. what do opponents of minimum wage believe are the results of minimum wage? increases personal income results in job shortages causes unemployment raises prices of goods

Answers: 1

Business, 22.06.2019 12:10

Lambert manufacturing has $100,000 to invest in either project a or project b. the following data are available on these projects (ignore income taxes.): project a project b cost of equipment needed now $100,000 $60,000 working capital investment needed now - $40,000 annual cash operating inflows $40,000 $35,000 salvage value of equipment in 6 years $10,000 - both projects will have a useful life of 6 years and the total cost approach to net present value analysis. at the end of 6 years, the working capital investment will be released for use elsewhere. lambert's required rate of return is 14%. the net present value of project b is:

Answers: 2

You know the right answer?

Questions

Mathematics, 22.02.2021 23:30

English, 22.02.2021 23:30

Physics, 22.02.2021 23:30

Mathematics, 22.02.2021 23:30

Mathematics, 22.02.2021 23:30

Mathematics, 22.02.2021 23:30

Mathematics, 22.02.2021 23:30

Arts, 22.02.2021 23:30

Mathematics, 22.02.2021 23:30

Biology, 22.02.2021 23:30

Mathematics, 22.02.2021 23:30

SAT, 22.02.2021 23:30

Mathematics, 22.02.2021 23:30

Business, 22.02.2021 23:30