Business, 16.03.2020 07:43 22MadisonT

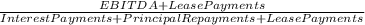

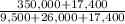

Ziebart Corp.'s EBITDA last year was $350,000 ( = EBIT + depreciation + amortization), its interest charges were $9,500, it had to repay $26,000 of long-term debt, and it had to make a payment of $17,400 under a long-term lease. The firm had no amortization charges. What was the EBITDA coverage ratio?

Answers: 1

Another question on Business

Business, 22.06.2019 15:30

Susan is a 5th grade teacher and loves getting up every day and going to work to teach her students. this is an example of a. extrinsic value b. interests c. intrinsic value d. external value

Answers: 2

Business, 22.06.2019 17:40

Within the relevant range, if there is a change in the level of the cost driver, then a. total fixed costs will remain the same and total variable costs will change b. total fixed costs will change and total variable costs will remain the same c. total fixed costs and total variable costs will change d. total fixed costs and total variable costs will remain the same

Answers: 3

Business, 22.06.2019 19:40

Last year ann arbor corp had $155,000 of assets, $305,000 of sales, $20,000 of net income, and a debt-to-total-assets ratio of 37.5%. the new cfo believes a new computer program will enable it to reduce costs and thus raise net income to $33,000. assets, sales, and the debt ratio would not be affected. by how much would the cost reduction improve the roe? a. 11.51%b. 12.11%c. 12.75%d. 13.42%e. 14.09%

Answers: 3

Business, 22.06.2019 21:20

White truffles are a very prized and rare edible fungus that grow naturally in the countryside near alba, italy. suppose that it costs $200 per day to search for white truffles. on an average day, the total number of white truffles (t) found in alba is t = 20x − x 2 , where x is the number of people searching for white truffles on that day. white truffles can be sold for $100 each. if there is no regulation, how many more people will be searching for white truffles than the socially optimal number?

Answers: 1

You know the right answer?

Ziebart Corp.'s EBITDA last year was $350,000 ( = EBIT + depreciation + amortization), its interest...

Questions

Biology, 22.01.2020 05:31

Mathematics, 22.01.2020 05:31

Geography, 22.01.2020 05:31

Mathematics, 22.01.2020 05:31

History, 22.01.2020 05:31

History, 22.01.2020 05:31

Mathematics, 22.01.2020 05:31

Chemistry, 22.01.2020 05:31

Mathematics, 22.01.2020 05:31

History, 22.01.2020 05:31