Business, 16.03.2020 16:30 gachaperson123

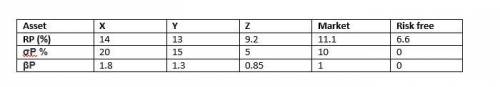

You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: Portfolio RP σP βP X 14.0 % 20 % 1.80 Y 13.0 15 1.30 Z 9.2 5 0.85 Market 11.1 10 1.00 Risk-free 6.6 0 0 What is the Sharpe ratio, Treynor ratio, and Jensen’s alpha for each portfolio?

Answers: 3

Another question on Business

Business, 22.06.2019 07:40

Alicia has a collision deductible of $500 and a bodily injury liability coverage limit of $50,000. she hits another driver and injures them severely. the case goes to trial and there is a verdict to compensate the injured person for $40,000 how much does she pay?

Answers: 1

Business, 22.06.2019 09:30

Stock market crashes happen when the value of most of the stocks in the stock market increase at the same time. question 10 options: true false

Answers: 1

Business, 22.06.2019 10:00

Your father offers you a choice of $120,000 in 11 years or $48,500 today. use appendix b as an approximate answer, but calculate your final answer using the formula and financial calculator methods. a-1. if money is discounted at 11 percent, what is the present value of the $120,000?

Answers: 3

Business, 22.06.2019 11:00

%of the world's population controls approximately % of the world's finances (the sum of gross domestic products)" quizlket

Answers: 1

You know the right answer?

You are given the following information concerning three portfolios, the market portfolio, and the r...

Questions

English, 02.09.2020 22:01

Medicine, 02.09.2020 22:01

English, 02.09.2020 22:01

Mathematics, 02.09.2020 22:01

Business, 02.09.2020 22:01

History, 02.09.2020 22:01

Mathematics, 02.09.2020 22:01

Mathematics, 02.09.2020 22:01

History, 02.09.2020 22:01

Mathematics, 02.09.2020 22:01

History, 02.09.2020 22:01

Mathematics, 02.09.2020 22:01

Computers and Technology, 02.09.2020 22:01