At the beginning of the current season on April 1, the ledger of Granite Hills Pro Shop showed Cash $2,500, Inventory $3,500, and Common Stock $6,000. The following transactions occurred during April 2017.

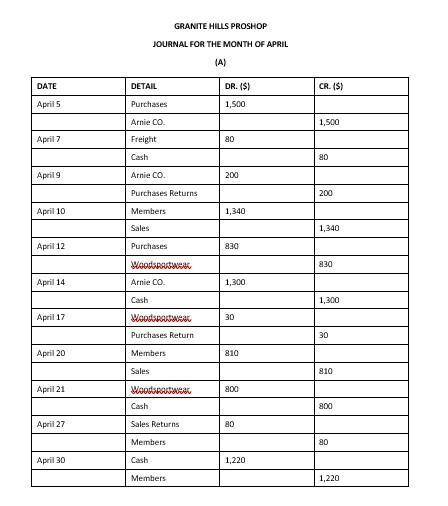

Apr. 5 Purchased golf bags, clubs, and balls on account from Arnie Co. $1,500, terms 3/10, n/60.

7 Paid freight on Arnie Co. purchases $80.

9 Received credit from Arnie Co. for merchandise returned $200. 10 Sold merchandise on account to members $1,340, terms n/30.

12 Purchased golf shoes, sweaters, and other accessories on account from Woods Sportswear $830, terms 1/10, n/30.

14 Paid Arnie Co. in full.

17 Received credit from Woods Sportswear for merchandise returned $30.

20 Made sales on account to members $810, terms n/30.

21 Paid Woods Sportswear in full.

27 Granted credit to members for clothing that did not fit properly $80.

30 Received payments on account from members $1,220. The chart of accounts for the pro shop includes Cash, Accounts Receivable, Inventory, Accounts Payable, Common Stock, Sales Revenue, Sales Returns and Allowances, Purchases, Purchase Returns and Allowances, Purchase Discounts, and Freight-In. Instructions

(a) Journalize the April transactions using a periodic inventory system.

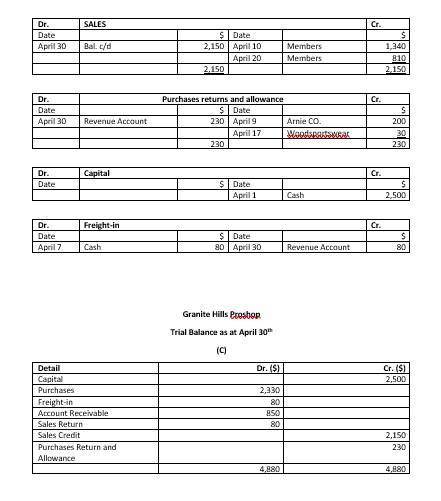

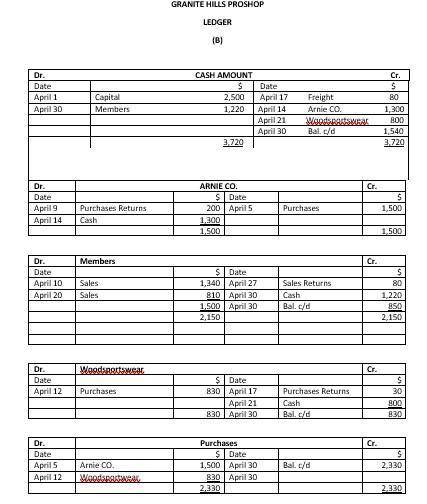

(b) Using T-accounts, enter the beginning balances in the ledger accounts and post the April transactions.

(c) Prepare a trial balance on April 30, 2017.

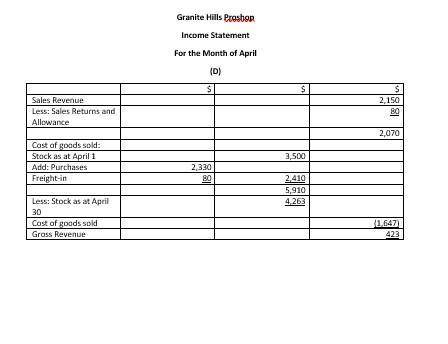

(d) Prepare an income statement through gross profit, assuming inventory on hand at April 30 is $4,263.

Answers: 3

Another question on Business

Business, 22.06.2019 10:10

Ursus, inc., is considering a project that would have a five-year life and would require a $1,650,000 investment in equipment. at the end of five years, the project would terminate and the equipment would have no salvage value. the project would provide net operating income each year as follows (ignore income taxes.):

Answers: 1

Business, 22.06.2019 12:30

M. cotteleer electronics supplies microcomputer circuitry to a company that incorporates microprocessors into refrigerators and other home appliances. one of the components has an annual demand of 235 units, and this is constant throughout the year. carrying cost is estimated to be $1.25 per unit per year, and the ordering (setup) cost is $21 per order. a) to minimize cost, how many units should be ordered each time an order is placed? b) how many orders per year are needed with the optimal policy? c) what is the average inventory if costs are minimized? d) suppose that the ordering cost is not $21, and cotteleer has been ordering 125 units each time an order is placed. for this order policy (of q = 125) to be optimal, determine what the ordering cost would have to be.

Answers: 1

Business, 22.06.2019 16:40

Job applications give employers uniform information for all employees,making it easier to

Answers: 1

Business, 22.06.2019 19:10

Ancho corp. is an automobile company whose core competency lies in manufacturing petrol- and diesel- based cars. the company realizes that more of its potential customers are switching to electric cars. the r& d department of the company acquires competencies in developing electric cars and launches its first hybrid car, which uses both gas and electricity. in this scenario, ancho is primarilya. leveraging new core competencies to improve current market position. b. redeploying existing core competencies to compete in future markets. c. unlearning existing core competencies to create and compete in markets of the future. d. building new core competencies to protect and extend current market position

Answers: 3

You know the right answer?

At the beginning of the current season on April 1, the ledger of Granite Hills Pro Shop showed Cash...

Questions

Mathematics, 23.06.2021 04:40

Mathematics, 23.06.2021 04:40

History, 23.06.2021 04:40

Biology, 23.06.2021 04:40

Mathematics, 23.06.2021 04:40

Mathematics, 23.06.2021 04:40

English, 23.06.2021 04:40