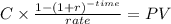

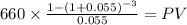

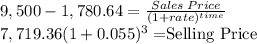

You have just purchased a municipal bond with a $10,000 par value for $9,500. You purchased it immediately after the previous owner received a semiannual interest payment. The bond rate is 6.6% per year payable semiannually. You plan to hold the bond for 3 years, selling the bond immediately after you receive the interest payment. If your desired nominal yield is 5.5% per year compounded semiannually, what will be your minimum selling price for the bond?

Answers: 3

Another question on Business

Business, 22.06.2019 04:40

Select the correct answerwhat is the responsibility of each of the twelve federal reserve's banks in their districts? a.they set the prime rateob.they monitor functioning of banks in their through onsite and offsite reviewsc.they assess taxes in their destnictd.they write fiscal policies

Answers: 1

Business, 22.06.2019 06:30

Ummit record company is negotiating with two banks for a $157,000 loan. fidelity bank requires a compensating balance of 24 percent, discounts the loan, and wants to be paid back in four quarterly payments. southwest bank requires a compensating balance of 12 percent, does not discount the loan, but wants to be paid back in 12 monthly installments. the stated rate for both banks is 9 percent. compensating balances will be subtracted from the $157,000 in determining the available funds in part a. a-1. calculate the effective interest rate for fidelity bank and southwest bank. (do not round intermediate calculations. input your answers as a percent rounded to 2 decimal places.) a-2. which loan should summit accept? southwest bank fidelity bank b. recompute the effective cost of interest, assuming that summit ordinarily maintains $37,680 at each bank in deposits that will serve as compensating balances

Answers: 1

Business, 22.06.2019 17:30

What do you think: would it be more profitable to own 200 shares of penny’s pickles or 1 share of exxon? why do you think that?

Answers: 1

You know the right answer?

You have just purchased a municipal bond with a $10,000 par value for $9,500. You purchased it immed...

Questions

Mathematics, 15.01.2021 19:40

Mathematics, 15.01.2021 19:40

Geography, 15.01.2021 19:40

Physics, 15.01.2021 19:40

Mathematics, 15.01.2021 19:40

Physics, 15.01.2021 19:40

Mathematics, 15.01.2021 19:40

Advanced Placement (AP), 15.01.2021 19:40

Computers and Technology, 15.01.2021 19:40