Business, 16.03.2020 22:13 bridgettebach

Trey claims a dependency exemption for both of his daughters, ages 14 and 17, at year-end. Trey files a joint return with his wife.

What amount of child credit will Trey be able to claim for his daughters under each of the following alternative situations?

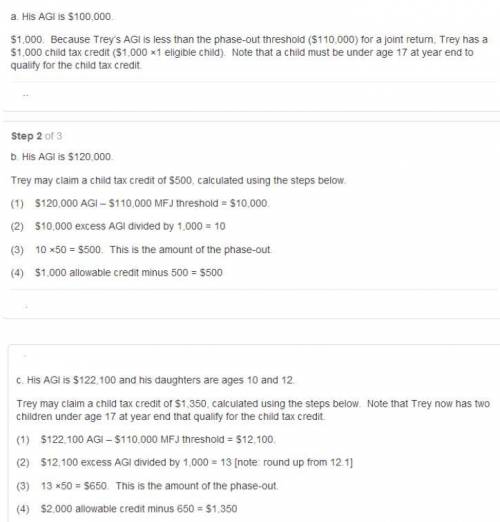

a. His AGI is $100,000.

b. His AGI is $120,000.

c. His AGI is $122,100, and his daughters are ages 10 and 12.

Answers: 2

Another question on Business

Business, 22.06.2019 02:20

Larissa has also provided the following information. during the year, the company raised $36 million in new long-term debt and retired $20.52 million in long-term debt. the company also sold $22 million in new stock and repurchased $32.4 million. the company purchased $54 million in fixed assets, and sold $6,107,400 in fixed assets. larissa has asked dan to prepare the financial statement of cash flows and the accounting statement of cash flows. she has also asked you to answer the following questions: 1. how would you describe east coast yachts' cash flows? 2. which cash flows statement more accurately describes the cash flows at the company? 3. in light of your previous answers, comment on larissa's expansion plans.

Answers: 2

Business, 22.06.2019 04:00

Don’t give me to many notifications because it will cause you to lose alot of points

Answers: 1

Business, 22.06.2019 05:30

Excel allows you to take a lot of data and organize it in one document. what are some of the features you can use to clarify, emphasize, and differentiate your data?

Answers: 2

Business, 22.06.2019 19:40

Anita has been named ceo of a popular sports apparel company. as ceo, she is tasked with setting the firm's corporate strategy. which of the following decisions is anita most likely to makea) whether to pursue a differentiation or cost leadership strategy b) which customer segments to target c) how to achieve the highest levels of customer satisfaction d) what range of products the firm should offer

Answers: 2

You know the right answer?

Trey claims a dependency exemption for both of his daughters, ages 14 and 17, at year-end. Trey file...

Questions

History, 08.04.2020 06:38

Mathematics, 08.04.2020 06:38

History, 08.04.2020 06:39

Mathematics, 08.04.2020 06:39

Mathematics, 08.04.2020 06:39

Health, 08.04.2020 06:39

History, 08.04.2020 06:39

English, 08.04.2020 06:39

Business, 08.04.2020 06:39