Business, 16.03.2020 22:31 briyantesol

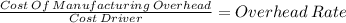

Aspen Company estimates its manufacturing overhead to be $515,000 and its direct labor costs to be $515,000 for year 2. Aspen worked on three jobs for the year. Job 2-1, which was sold during year 2, had actual direct labor costs of $221,400. Job 2-2, which was completed, but not sold at the end of the year, had actual direct labor costs of $459,200. Job 2-3, which is still in work-in-process inventory, had actual direct labor costs of $139,400. Actual manufacturing overhead for year 2 was $805,900. Manufacturing overhead is applied on the basis of direct labor costs. Required: Prepare an entry to allocate over- or underapplied overhead to Work in Process, Finished Goods and Cost of Goods Sold. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Answers: 3

Another question on Business

Business, 21.06.2019 19:30

What is the most important factor that affects the value of a company? a) cash flow b) earnings c) supply and demand d) number of employees

Answers: 1

Business, 21.06.2019 22:50

The following data pertains to activity and costs for two months: june july activity level in 10,000 12,000 direct materials $16,000 $ ? fixed factory rent 12,000 ? manufacturing overhead 10,000 ? total cost $38,000 $42,900 assuming that these activity levels are within the relevant range, the manufacturing overhead for july was: a) $10,000 b) $11,700 c) $19,000 d) $9,300

Answers: 2

Business, 22.06.2019 08:30

Kiona co. set up a petty cash fund for payments of small amounts. the following transactions involving the petty cash fund occurred in may (the last month of the company's fiscal year). may 1 prepared a company check for $350 to establish the petty cash fund. 15 prepared a company check to replenish the fund for the following expenditures made since may 1. a. paid $109.20 for janitorial services. b. paid $89.15 for miscellaneous expenses. c. paid postage expenses of $60.90. d. paid $80.01 to the county gazette (the local newspaper) for an advertisement. e. counted $26.84 remaining in the petty cashbox. 16 prepared a company check for $200 to increase the fund to $550. 31 the petty cashier reports that $380.27 cash remains in the fund. a company check is drawn to replenish the fund for the following expenditures made since may 15. f. paid postage expenses of $59.10. g. reimbursed the office manager for business mileage, $47.05. h. paid $48.58 to deliver merchandise to a customer, terms fob destination. 31 the company decides that the may 16 increase in the fund was too large. it reduces the fund by $50, leaving a total of $500.

Answers: 1

You know the right answer?

Aspen Company estimates its manufacturing overhead to be $515,000 and its direct labor costs to be $...

Questions

Health, 16.10.2019 02:30

History, 16.10.2019 02:30

Social Studies, 16.10.2019 02:30

Biology, 16.10.2019 02:30

Biology, 16.10.2019 02:30

Mathematics, 16.10.2019 02:30

Chemistry, 16.10.2019 02:30

Mathematics, 16.10.2019 02:30

![\left[\begin{array}{cccc}Item&Value&Weight&Allocated\\COGS&221400&0.27&3807\\FG&459200&0.56&7896\\WIP&139400&0.17&2397\\&&&\\Total&820000&1&14100\\\end{array}\right]](/tpl/images/0549/4102/772ae.png)