Business, 17.03.2020 04:38 loredobrooke5245

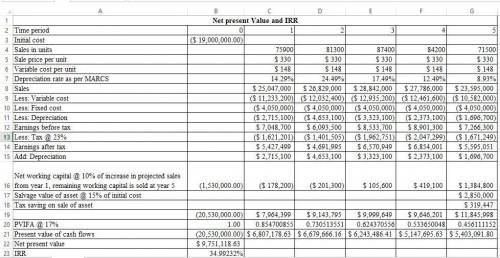

Aday Acoustics, Inc., projects unit sales for a new 7-octave voice emulation implant as follows: Year Unit Sales 1 75,900 2 81,300 3 87,400 4 84,200 5 71,500 Production of the implants will require $1,530,000 in net working capital to start and additional net working capital investments each year equal to 10 percent of the projected sales increase for the following year. Total fixed costs are $4,050,000 per year, variable production costs are $148 per unit, and the units are priced at $330 each. The equipment needed to begin production has an installed cost of $19,000,000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as 7-year MACRS property. In five years, this equipment can be sold for about 15 percent of its acquisition cost. The company is in the 23 percent marginal tax bracket and has a required return on all its projects of 17 percent. MACRS schedule. What is the NPV of the project?What is the IRR of the project?

Answers: 2

Another question on Business

Business, 22.06.2019 01:10

Technology corp. is considering a $238,160 investment in a new marketing campaign that it anticipates will provide annual cash flows of $52,000 for the next five years. the firm has a 6% cost of capital. what should the analysis indicate to the firm's managers?

Answers: 2

Business, 22.06.2019 19:00

Which of the following would cause a shift to the right of the supply curve for gasoline? i. a large increase in the price of public transportation. ii. a large decrease in the price of automobiles. iii. a large reduction in the costs of producing gasoline

Answers: 1

Business, 23.06.2019 11:40

Mandela manufacturing thinks that the best activity base for its manufacturing overhead is machine hours. the estimate of annual overhead costs is $540,000. the company used 1,000 hours of processing for job a15 during the period and incurred actual overhead costs of $580,000. the budgeted machine hours for the year totaled 20,000. what amount of manufacturing overhead should be applied to job a15? $29,000. $540. $580. $27,000.

Answers: 2

Business, 23.06.2019 16:00

Which best describes which careers would work in offices? 1.marketing information management and research, distribution and logistics, and marketing communications and promotion employees can work in offices.2.all marketing, sales, and service employees can work in offices.3.all marketing, sales, and service employees except those in management and entrepreneurship can work in offices.4.sales and service employees work in offices, but marketing employees do not

Answers: 1

You know the right answer?

Aday Acoustics, Inc., projects unit sales for a new 7-octave voice emulation implant as follows: Yea...

Questions

English, 16.02.2021 05:30

Mathematics, 16.02.2021 05:30

Mathematics, 16.02.2021 05:30

Mathematics, 16.02.2021 05:30

Arts, 16.02.2021 05:30

Mathematics, 16.02.2021 05:30