Business, 17.03.2020 05:01 shongmadi77

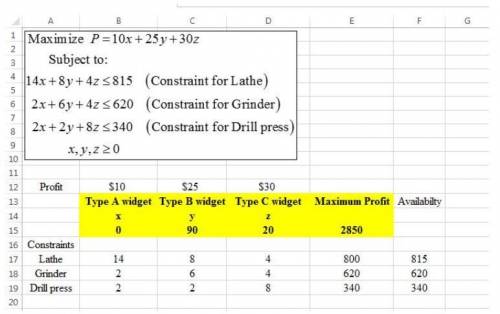

A widget manufacturer has the capability of making three types of widgets. Type A widgets require 14 minutes on a lathe, 2 minutes on a grinder, and 2 minutes on a drill press, and produce a profit of $10. Type B widgets require 8 minutes on a lathe, 5 minutes on a grinder, and 2 minutes on a drill press, and produce a profit of $20. Type C widgets require 4 minutes on a lathe, 4 minutes on a grinder, and 8 minutes on a drill press, and produce a profit of $30. Each day, 720 minutes of lathe time, 460 minutes of grinder time, and 280 minutes of drill press time are available. How many of each type of widget should be produced each day to maximize the profit? What is the maximum profit?

Answers: 1

Another question on Business

Business, 22.06.2019 04:10

Lynch company manufactures and sells a single product. the following costs were incurred during the company’s first year of operations: variable costs per unit: manufacturing: direct materials $ 12 direct labor $ 6 variable manufacturing overhead $ 1 variable selling and administrative $ 1 fixed costs per year: fixed manufacturing overhead $ 308,000 fixed selling and administrative $ 218,000 during the year, the company produced 28,000 units and sold 15,000 units. the selling price of the company’s product is $56 per unit. required: 1. assume that the company uses absorption costing: a. compute the unit product cost. b. prepare an income statement for the year. 2. assume that the company uses variable costing: a. compute the unit product cost. b. prepare an income statement for the year.

Answers: 1

Business, 22.06.2019 13:30

Presented below is information for annie company for the month of march 2018. cost of goods sold $245,000 rent expense $ 36,000 freight-out 7,000 sales discounts 8,000 insurance expense 5,000 sales returns and allowances 11,000 salaries and wages expense 63,000 sales revenue 410,000 instructions prepare the income statement.

Answers: 2

Business, 22.06.2019 14:30

crow design, inc. is a web site design and consulting firm. the firm uses a job order costing system in which each client is a different job. crow design assigns direct labor, licensing costs, and travel costs directly to each job. it allocates indirect costs to jobs based on a predetermined overhead allocation rate, computed as a percentage of direct labor costs. direct labor hours (professional) 6,250 hours direct labor costs ($1,800,000 support staff salaries ,000 computer ,000 office ,000 office ,000 in november 2012, crow design served several clients. records for two clients appear here: delicious treats mesilla chocolates direct labor 700 hours 100 hours software licensing $ 4,000 $400 travel costs 8,000 1. compute crow design’s direct labor rate and its predetermined indirect cost allocation rate for 2012. 2. compute the total cost of each job. 3. if simone wants to earn profits equal to 50% of service revenue, how much (what fee) should she charge each of these two clients? 4. why does crow design assign costs to jobs?

Answers: 2

Business, 22.06.2019 14:30

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

You know the right answer?

A widget manufacturer has the capability of making three types of widgets. Type A widgets require 14...

Questions

Arts, 19.12.2020 01:00

Geography, 19.12.2020 01:00

English, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

Health, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

Chemistry, 19.12.2020 01:00

History, 19.12.2020 01:00