Business, 18.03.2020 22:55 ayoismeisalex

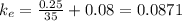

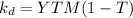

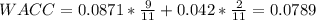

Time Warner shares have a market capitalization of $ 45 billion. The company just paid a dividend of $ 0.25 per share and each share trades for $ 35. The growth rate in dividends is expected to be 8% per year. Also, Time Warner has $ 10 billion of debt that trades with a yield to maturity of 7%. If the firm's tax rate is 40%, compute the WACC?

Answers: 1

Another question on Business

Business, 22.06.2019 04:30

Peyton taylor drew a map with scale 1 cm to 10 miles. on his map, the distance between silver city and golden canyon is 3.75 cm. what is the actual distance between silver city and golden canyon?

Answers: 3

Business, 22.06.2019 11:00

Abank provides its customers mobile applications that significantly simplify traditional banking activities. for example, a customer can use a smartphone to take a picture of a check and electronically deposit into an account. this unique service demonstrates the bank’s desire to practice which one of porter’s strategies?

Answers: 3

Business, 22.06.2019 11:10

Use the following account numbers and corresponding account titles to answer the following question. account no. account title (1) cash (2) merchandise inventory (3) cost of goods sold (4) transportation-out (5) dividends (6) common stock (7) selling expense (8) loss on the sale of land (9) sales which accounts would appear on the income statement?

Answers: 3

Business, 22.06.2019 14:20

For the year ended december 31, a company has revenues of $323,000 and expenses of $199,000. the company paid $52,400 in dividends during the year. the balance in the retained earnings account before closing is $87,000. which of the following entries would be used to close the dividends account?

Answers: 3

You know the right answer?

Time Warner shares have a market capitalization of $ 45 billion. The company just paid a dividend of...

Questions

Biology, 28.11.2019 07:31

Physics, 28.11.2019 07:31

Mathematics, 28.11.2019 07:31

English, 28.11.2019 07:31

Health, 28.11.2019 07:31

Social Studies, 28.11.2019 07:31

Physics, 28.11.2019 07:31

Biology, 28.11.2019 07:31