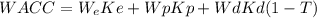

The firm's target capital structure is the mix of debt, preferred stock, and common equity the firm plans to raise funds for its future projects. The target proportions of debt, preferred stock, and common equity, along with the cost of these components, are used to calculate the firm's weighted average cost of capital (WACC). If the firm will not have to issue new common stock, then the cost of retained earnings is used in the firm's WACC calculation. However, if the firm will have to issue new common stock, the cost of new common stock should be used in the firm's WACC calculation.

Quantitative Problem:

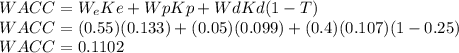

Barton Industries expects that its target capital structure for raising funds in the future for its capital budget will consist of 40% debt, 5% preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 25%. Assume that the firm's cost of debt, rd, is 10.7%, the firm's cost of preferred stock, rp, is 9.9% and the firm's cost of equity is 13.3% for old equity, rs, and 13.9% for new equity, re.

What is the firm's weighted average cost of capital (WACC1) if it uses retained earnings as its source of common equity?

Answers: 2

Another question on Business

Business, 22.06.2019 14:20

For the year ended december 31, a company has revenues of $323,000 and expenses of $199,000. the company paid $52,400 in dividends during the year. the balance in the retained earnings account before closing is $87,000. which of the following entries would be used to close the dividends account?

Answers: 3

Business, 22.06.2019 15:20

Record the journal entry for the provision for uncollectible accounts under each of the following independent assumptions: a. the allowance for doubtful accounts before adjustment has a credit balance of $500. b. the allowance for doubtful accounts before adjustment has a debit balance of $250. c. assume that octoberʼs credit sales were $70,000. uncollectible accounts expense is estimated at 2% of sales. smith, gaylord n.. excel applications for accounting principles (p. 51). cengage textbook. kindle edition.

Answers: 1

Business, 22.06.2019 15:30

Careers in designing, planning, managing, building and maintaining the built environment can be found in the following career cluster: a. agriculture, food & natural resources b. architecture & construction c. arts, audio-video technology & communications d. business, management & administration

Answers: 2

Business, 22.06.2019 17:40

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

You know the right answer?

The firm's target capital structure is the mix of debt, preferred stock, and common equity the firm...

Questions

Social Studies, 28.11.2019 21:31

Social Studies, 28.11.2019 21:31

English, 28.11.2019 21:31